NPC Resources Berhad (KLSE:NPC) Screens Well But There Might Be A Catch

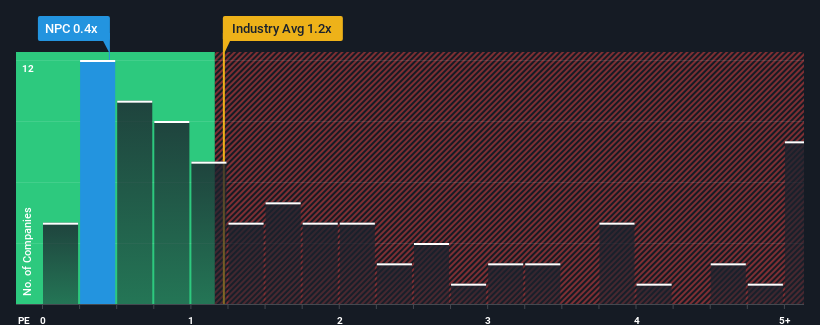

When you see that almost half of the companies in the Food industry in Malaysia have price-to-sales ratios (or "P/S") above 1.2x, NPC Resources Berhad (KLSE:NPC) looks to be giving off some buy signals with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for NPC Resources Berhad

What Does NPC Resources Berhad's Recent Performance Look Like?

The revenue growth achieved at NPC Resources Berhad over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on NPC Resources Berhad's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like NPC Resources Berhad's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.2%. This was backed up an excellent period prior to see revenue up by 69% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 8.3% shows it's noticeably more attractive.

With this information, we find it odd that NPC Resources Berhad is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see NPC Resources Berhad currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with NPC Resources Berhad (including 2 which are significant).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if NPC Resources Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NPC

NPC Resources Berhad

An investment holding company, engages in oil palm plantation and milling activities in Malaysia and Indonesia.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives