David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies LTKM Berhad (KLSE:LTKM) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for LTKM Berhad

What Is LTKM Berhad's Debt?

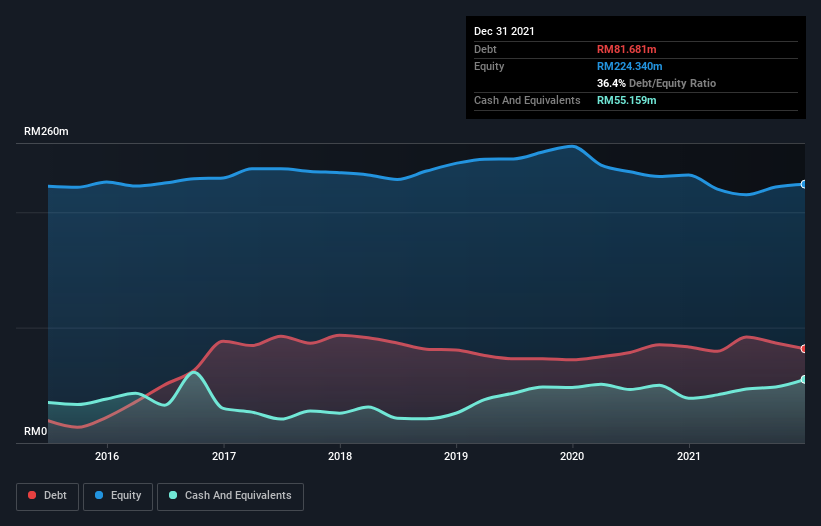

The chart below, which you can click on for greater detail, shows that LTKM Berhad had RM81.7m in debt in December 2021; about the same as the year before. However, because it has a cash reserve of RM55.2m, its net debt is less, at about RM26.5m.

How Strong Is LTKM Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that LTKM Berhad had liabilities of RM68.9m due within 12 months and liabilities of RM40.1m due beyond that. On the other hand, it had cash of RM55.2m and RM20.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM32.9m.

Of course, LTKM Berhad has a market capitalization of RM210.4m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is LTKM Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, LTKM Berhad reported revenue of RM181m, which is a gain of 34%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

While we can certainly appreciate LTKM Berhad's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. Indeed, it lost RM11m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of RM19m into a profit. So to be blunt we do think it is risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for LTKM Berhad you should be aware of, and 1 of them is potentially serious.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LTKM

LTKM Berhad

An investment holding company, provides poultry and related products in Malaysia.

Flawless balance sheet and good value.

Market Insights

Community Narratives