This Broker Just Slashed Their Kawan Food Berhad (KLSE:KAWAN) Earnings Forecasts

One thing we could say about the covering analyst on Kawan Food Berhad (KLSE:KAWAN) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analyst has soured majorly on the business.

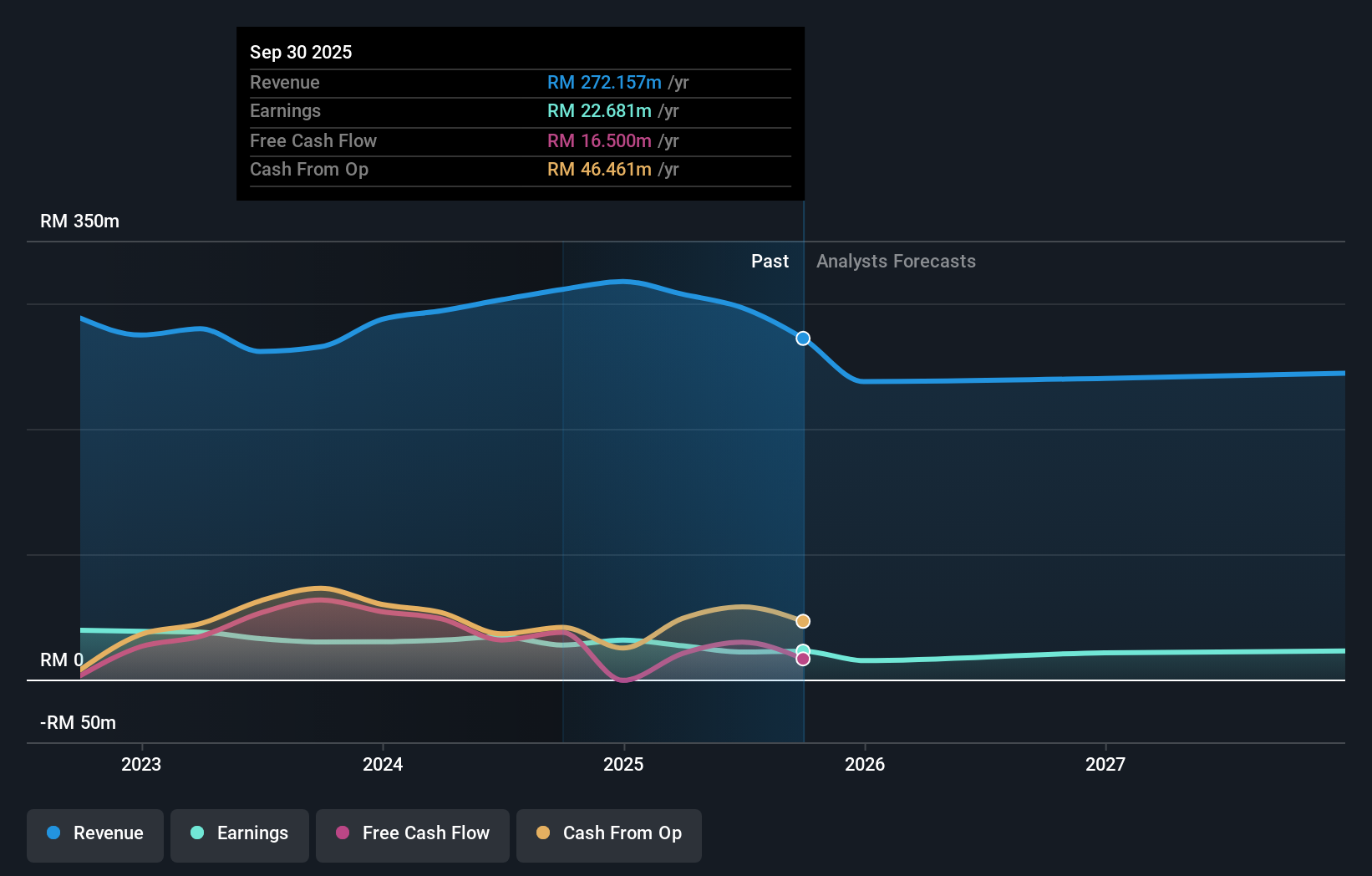

Following the latest downgrade, the current consensus, from the single analyst covering Kawan Food Berhad, is for revenues of RM238m in 2025, which would reflect a not inconsiderable 13% reduction in Kawan Food Berhad's sales over the past 12 months. Statutory earnings per share are anticipated to crater 37% to RM0.042 in the same period. Previously, the analyst had been modelling revenues of RM280m and earnings per share (EPS) of RM0.067 in 2025. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a large cut to earnings per share numbers as well.

See our latest analysis for Kawan Food Berhad

It'll come as no surprise then, to learn that the analyst has cut their price target 11% to RM1.07.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Kawan Food Berhad's past performance and to peers in the same industry. We would highlight that sales are expected to reverse, with a forecast 13% annualised revenue decline to the end of 2025. That is a notable change from historical growth of 4.2% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 2.9% per year. It's pretty clear that Kawan Food Berhad's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that the analyst has reduced their earnings per share estimates, suggesting business headwinds lay ahead for Kawan Food Berhad. Unfortunately the analyst also downgraded their revenue estimates, and industry data suggests that Kawan Food Berhad's revenues are expected to grow slower than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Kawan Food Berhad going out as far as 2027, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Kawan Food Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KAWAN

Kawan Food Berhad

An investment holding company, manufactures, trades in, distributes, and sells frozen food products.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success