British American Tobacco (Malaysia) Berhad's (KLSE:BAT) Dividend Is Being Reduced To MYR0.15

British American Tobacco (Malaysia) Berhad's (KLSE:BAT) dividend is being reduced from last year's payment covering the same period to MYR0.15 on the 5th of March. However, the dividend yield of 7.1% still remains in a typical range for the industry.

See our latest analysis for British American Tobacco (Malaysia) Berhad

British American Tobacco (Malaysia) Berhad's Dividend Is Well Covered By Earnings

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. The last payment made up 92% of earnings, but cash flows were much higher. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

The next year is set to see EPS grow by 14.1%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 69% which brings it into quite a comfortable range.

Dividend Volatility

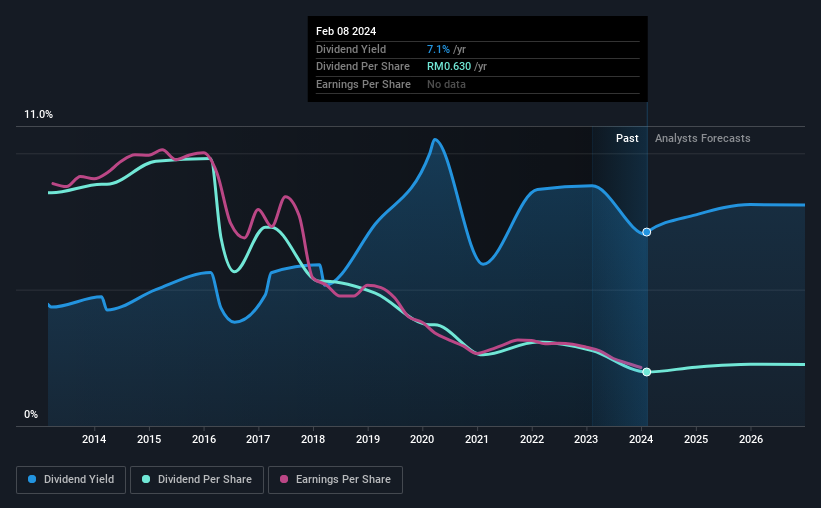

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the dividend has gone from MYR2.72 total annually to MYR0.63. This works out to a decline of approximately 77% over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Has Limited Growth Potential

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Over the past five years, it looks as though British American Tobacco (Malaysia) Berhad's EPS has declined at around 16% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

In Summary

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 3 warning signs for British American Tobacco (Malaysia) Berhad that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if British American Tobacco (Malaysia) Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BAT

British American Tobacco (Malaysia) Berhad

Engages in the manufacture, sale, marketing and importation of cigarettes, pipe tobaccos, cigars, devices, other tobacco products, and nicotine products in Malaysia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives