- Malaysia

- /

- Energy Services

- /

- KLSE:VELESTO

Optimistic Investors Push Velesto Energy Berhad (KLSE:VELESTO) Shares Up 30% But Growth Is Lacking

Velesto Energy Berhad (KLSE:VELESTO) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

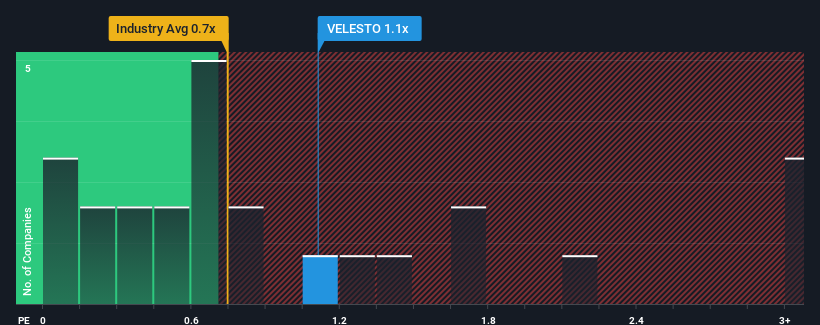

Although its price has surged higher, it's still not a stretch to say that Velesto Energy Berhad's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Energy Services industry in Malaysia, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Velesto Energy Berhad

How Velesto Energy Berhad Has Been Performing

Recent times have been advantageous for Velesto Energy Berhad as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Velesto Energy Berhad will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Velesto Energy Berhad?

In order to justify its P/S ratio, Velesto Energy Berhad would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 15% as estimated by the eight analysts watching the company. The industry is also set to see revenue decline 11% but the stock is shaping up to perform materially worse.

With this in mind, we find it intriguing that Velesto Energy Berhad's P/S is similar to its industry peers. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Final Word

Its shares have lifted substantially and now Velesto Energy Berhad's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Velesto Energy Berhad's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. This presents a risk to investors if the P/S were to decline to a level that more accurately reflects the company's revenue prospects.

Before you settle on your opinion, we've discovered 3 warning signs for Velesto Energy Berhad (1 is potentially serious!) that you should be aware of.

If you're unsure about the strength of Velesto Energy Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:VELESTO

Velesto Energy Berhad

An investment holding company, engages in activities in the upstream sector of the oil and gas industry in Malaysia and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives