- Malaysia

- /

- Specialty Stores

- /

- KLSE:PETDAG

PETRONAS Dagangan Berhad (KLSE:PETDAG) Has A Pretty Healthy Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, PETRONAS Dagangan Berhad (KLSE:PETDAG) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for PETRONAS Dagangan Berhad

What Is PETRONAS Dagangan Berhad's Debt?

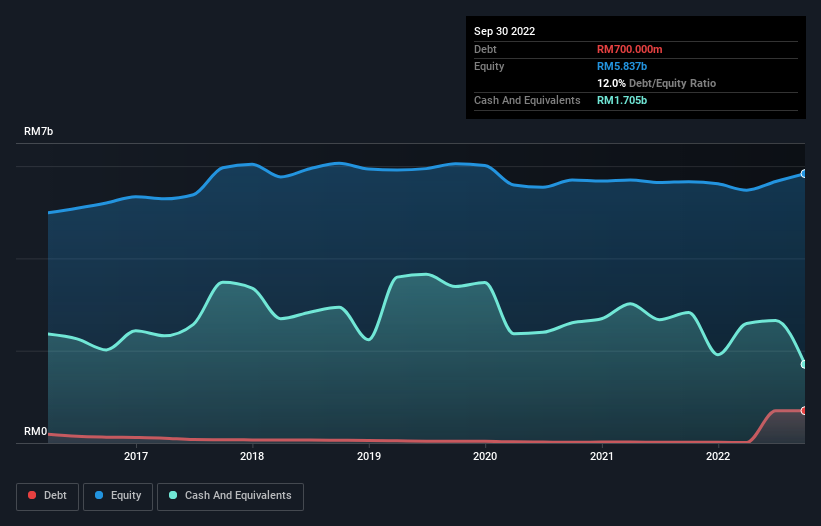

As you can see below, at the end of September 2022, PETRONAS Dagangan Berhad had RM700.0m of debt, up from RM16.0m a year ago. Click the image for more detail. However, it does have RM1.71b in cash offsetting this, leading to net cash of RM1.01b.

A Look At PETRONAS Dagangan Berhad's Liabilities

According to the last reported balance sheet, PETRONAS Dagangan Berhad had liabilities of RM13.7b due within 12 months, and liabilities of RM261.1m due beyond 12 months. Offsetting this, it had RM1.71b in cash and RM13.9b in receivables that were due within 12 months. So it actually has RM1.59b more liquid assets than total liabilities.

This short term liquidity is a sign that PETRONAS Dagangan Berhad could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that PETRONAS Dagangan Berhad has more cash than debt is arguably a good indication that it can manage its debt safely.

In addition to that, we're happy to report that PETRONAS Dagangan Berhad has boosted its EBIT by 52%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if PETRONAS Dagangan Berhad can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While PETRONAS Dagangan Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, PETRONAS Dagangan Berhad saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

While it is always sensible to investigate a company's debt, in this case PETRONAS Dagangan Berhad has RM1.01b in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 52% over the last year. So we are not troubled with PETRONAS Dagangan Berhad's debt use. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for PETRONAS Dagangan Berhad (1 can't be ignored) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PETDAG

PETRONAS Dagangan Berhad

Engages in retailing and marketing of downstream petroleum products primarily in Malaysia.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026