- Malaysia

- /

- Oil and Gas

- /

- KLSE:HIBISCS

Further Upside For Hibiscus Petroleum Berhad (KLSE:HIBISCS) Shares Could Introduce Price Risks After 26% Bounce

Hibiscus Petroleum Berhad (KLSE:HIBISCS) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

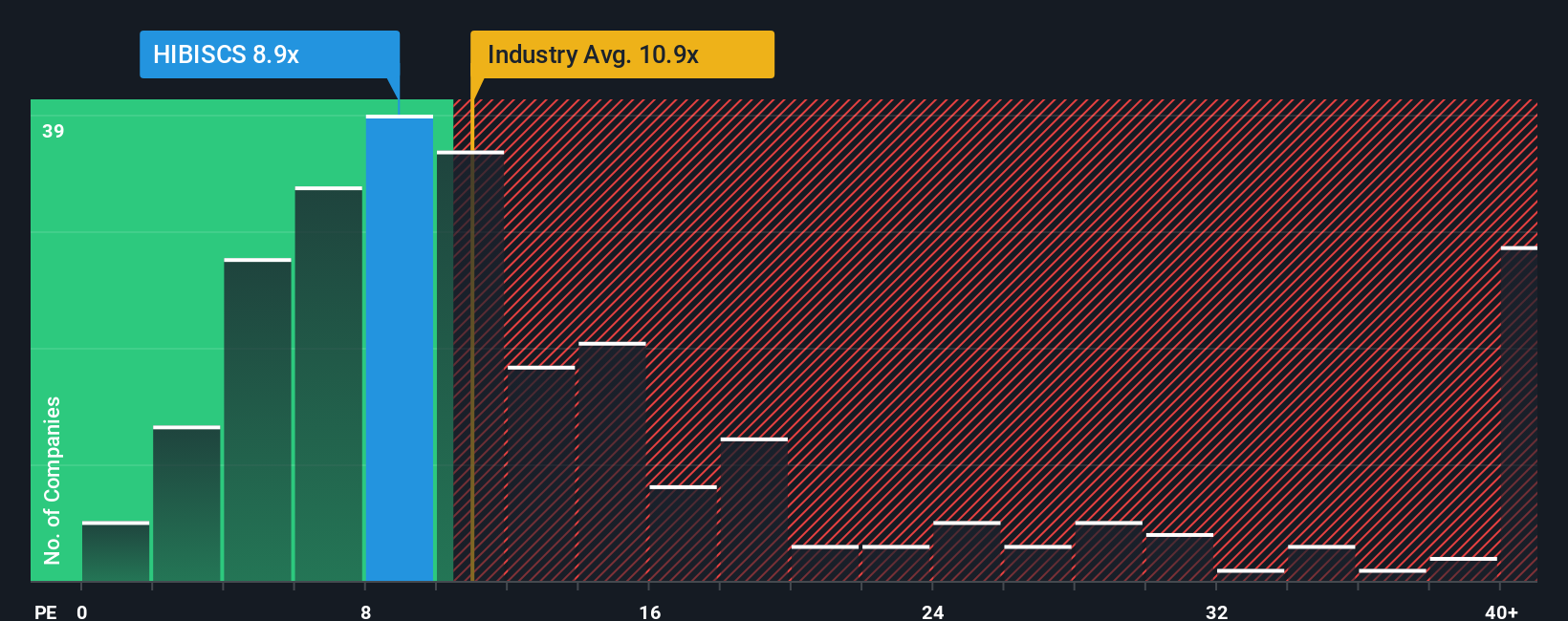

Even after such a large jump in price, Hibiscus Petroleum Berhad may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.9x, since almost half of all companies in Malaysia have P/E ratios greater than 14x and even P/E's higher than 25x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Hibiscus Petroleum Berhad could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Hibiscus Petroleum Berhad

Is There Any Growth For Hibiscus Petroleum Berhad?

Hibiscus Petroleum Berhad's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 68%. This means it has also seen a slide in earnings over the longer-term as EPS is down 63% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 131% as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 14%, which is noticeably less attractive.

With this information, we find it odd that Hibiscus Petroleum Berhad is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift Hibiscus Petroleum Berhad's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hibiscus Petroleum Berhad currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for Hibiscus Petroleum Berhad that we have uncovered.

Of course, you might also be able to find a better stock than Hibiscus Petroleum Berhad. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hibiscus Petroleum Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HIBISCS

Hibiscus Petroleum Berhad

Engages in the exploration, development, and sale of oil and gas in Peninsular Malaysia, Sabah, Malaysia, the United Kingdom, Brunei, Australia, and Vietnam.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives