Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Bumi Armada Berhad (KLSE:ARMADA) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Bumi Armada Berhad

What Is Bumi Armada Berhad's Net Debt?

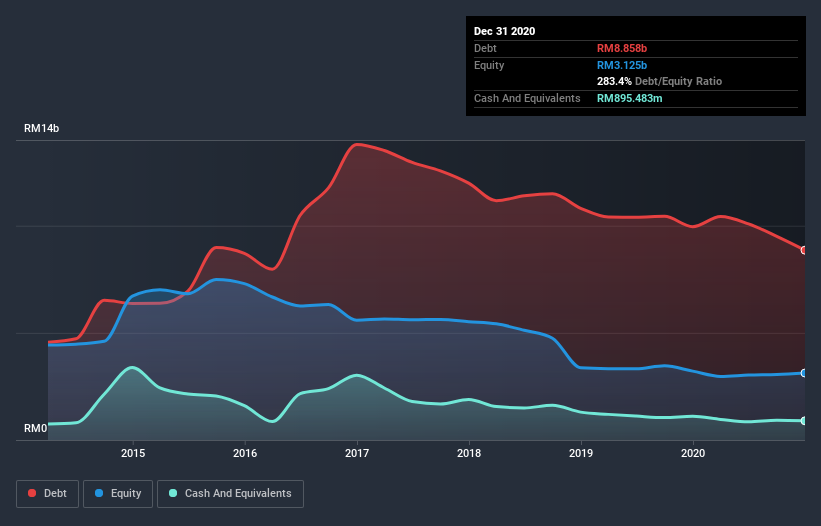

As you can see below, Bumi Armada Berhad had RM8.86b of debt at December 2020, down from RM9.95b a year prior. However, because it has a cash reserve of RM895.5m, its net debt is less, at about RM7.96b.

A Look At Bumi Armada Berhad's Liabilities

Zooming in on the latest balance sheet data, we can see that Bumi Armada Berhad had liabilities of RM2.06b due within 12 months and liabilities of RM7.46b due beyond that. Offsetting this, it had RM895.5m in cash and RM893.3m in receivables that were due within 12 months. So its liabilities total RM7.73b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the RM2.65b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Bumi Armada Berhad would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 1.9 times and a disturbingly high net debt to EBITDA ratio of 5.6 hit our confidence in Bumi Armada Berhad like a one-two punch to the gut. The debt burden here is substantial. The good news is that Bumi Armada Berhad grew its EBIT a smooth 31% over the last twelve months. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Bumi Armada Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, Bumi Armada Berhad actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

While Bumi Armada Berhad's level of total liabilities has us nervous. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. When we consider all the factors discussed, it seems to us that Bumi Armada Berhad is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with Bumi Armada Berhad (at least 1 which is significant) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Bumi Armada Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bumi Armada Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ARMADA

Bumi Armada Berhad

An investment holding company, engages in providing marine transportation, floating production storage offloading (FPSO) operations, and engineering and maintenance services to offshore oil and gas companies.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026