- Malaysia

- /

- Capital Markets

- /

- KLSE:INSAS

Insas Berhad's (KLSE:INSAS) Prospects Need A Boost To Lift Shares

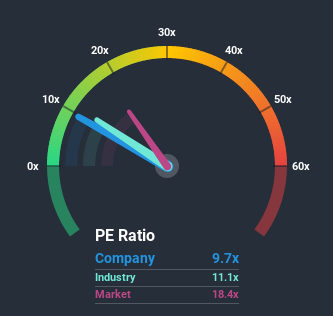

With a price-to-earnings (or "P/E") ratio of 9.7x Insas Berhad (KLSE:INSAS) may be sending bullish signals at the moment, given that almost half of all companies in Malaysia have P/E ratios greater than 19x and even P/E's higher than 32x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, Insas Berhad's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Insas Berhad

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Insas Berhad's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 15%. The last three years don't look nice either as the company has shrunk EPS by 62% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 27% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Insas Berhad is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Insas Berhad's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Insas Berhad revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Insas Berhad you should be aware of, and 1 of them shouldn't be ignored.

You might be able to find a better investment than Insas Berhad. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

When trading Insas Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:INSAS

Insas Berhad

An investment holding company, trades in securities in Malaysia, Singapore, and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success