- Malaysia

- /

- Consumer Services

- /

- KLSE:SMRT

Here's Why SMRT Holdings Berhad (KLSE:SMRT) Has A Meaningful Debt Burden

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, SMRT Holdings Berhad (KLSE:SMRT) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for SMRT Holdings Berhad

How Much Debt Does SMRT Holdings Berhad Carry?

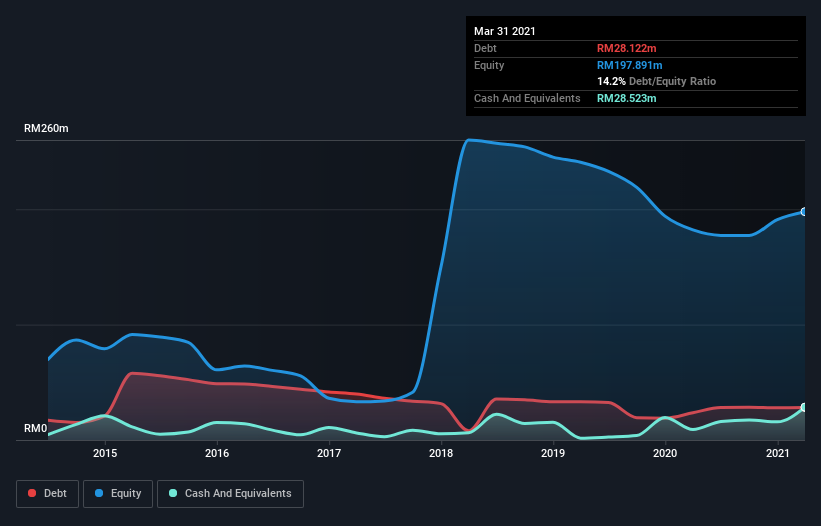

You can click the graphic below for the historical numbers, but it shows that as of March 2021 SMRT Holdings Berhad had RM28.1m of debt, an increase on RM23.6m, over one year. But it also has RM28.5m in cash to offset that, meaning it has RM400.8k net cash.

How Healthy Is SMRT Holdings Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that SMRT Holdings Berhad had liabilities of RM101.5m due within 12 months and liabilities of RM204.1m due beyond that. Offsetting this, it had RM28.5m in cash and RM64.9m in receivables that were due within 12 months. So its liabilities total RM212.1m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the RM66.8m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, SMRT Holdings Berhad would likely require a major re-capitalisation if it had to pay its creditors today. Given that SMRT Holdings Berhad has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

We also note that SMRT Holdings Berhad improved its EBIT from a last year's loss to a positive RM21m. The balance sheet is clearly the area to focus on when you are analysing debt. But it is SMRT Holdings Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. SMRT Holdings Berhad may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last year, SMRT Holdings Berhad generated free cash flow amounting to a very robust 94% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Summing up

Although SMRT Holdings Berhad's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of RM400.8k. The cherry on top was that in converted 94% of that EBIT to free cash flow, bringing in RM20m. Despite its cash we think that SMRT Holdings Berhad seems to struggle to handle its total liabilities, so we are wary of the stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with SMRT Holdings Berhad (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SMRT

SMRT Holdings Berhad

An investment holding company, engages information technology businesses primarily in Malaysia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026