- Malaysia

- /

- Hospitality

- /

- KLSE:MBRIGHT

Meta Bright Group Berhad's (KLSE:MBRIGHT) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- Meta Bright Group Berhad to hold its Annual General Meeting on 2nd of December

- CEO Chee Lee's total compensation includes salary of RM420.0k

- The overall pay is 33% above the industry average

- Meta Bright Group Berhad's EPS declined by 2.6% over the past three years while total shareholder loss over the past three years was 12%

In the past three years, the share price of Meta Bright Group Berhad (KLSE:MBRIGHT) has struggled to generate growth for its shareholders. Per share earnings growth is also poor, despite revenues growing. Shareholders will have a chance to take their concerns to the board at the next AGM on 2nd of December and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

View our latest analysis for Meta Bright Group Berhad

How Does Total Compensation For Chee Lee Compare With Other Companies In The Industry?

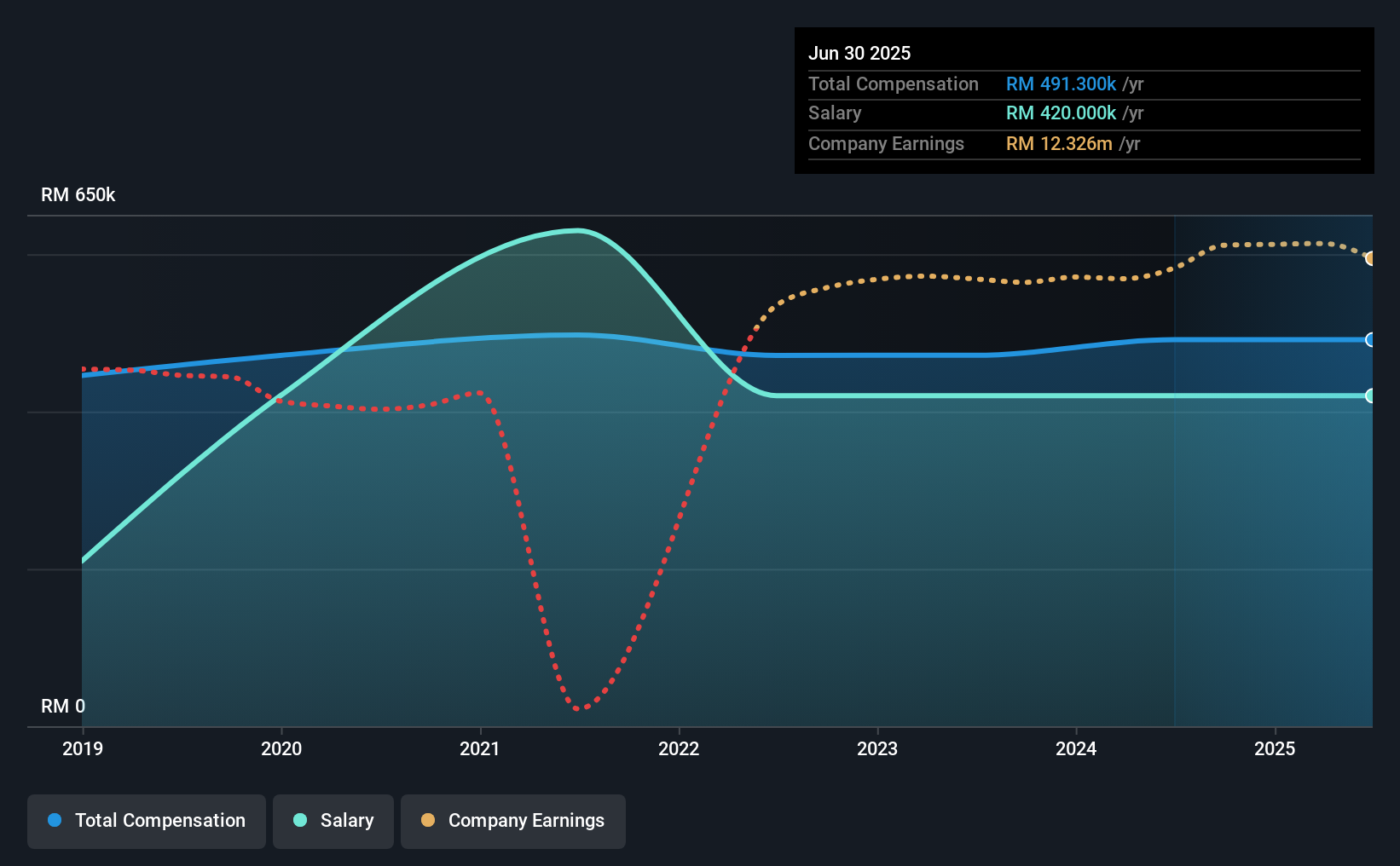

At the time of writing, our data shows that Meta Bright Group Berhad has a market capitalization of RM312m, and reported total annual CEO compensation of RM491k for the year to June 2025. This means that the compensation hasn't changed much from last year. Notably, the salary which is RM420.0k, represents most of the total compensation being paid.

In comparison with other companies in the Malaysian Hospitality industry with market capitalizations under RM827m, the reported median total CEO compensation was RM368k. Accordingly, our analysis reveals that Meta Bright Group Berhad pays Chee Lee north of the industry median. What's more, Chee Lee holds RM12m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | RM420k | RM420k | 85% |

| Other | RM71k | RM71k | 15% |

| Total Compensation | RM491k | RM491k | 100% |

On an industry level, roughly 73% of total compensation represents salary and 27% is other remuneration. According to our research, Meta Bright Group Berhad has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Meta Bright Group Berhad's Growth

Meta Bright Group Berhad has reduced its earnings per share by 2.6% a year over the last three years. Its revenue is up 133% over the last year.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Meta Bright Group Berhad Been A Good Investment?

With a three year total loss of 12% for the shareholders, Meta Bright Group Berhad would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 3 warning signs for Meta Bright Group Berhad that investors should look into moving forward.

Important note: Meta Bright Group Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MBRIGHT

Meta Bright Group Berhad

An investment holding company, engages in property development and investment, and hotel operations businesses primarily in Malaysia and Australia.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success