- Malaysia

- /

- Hospitality

- /

- KLSE:MAGNUM

Do These 3 Checks Before Buying Magnum Berhad (KLSE:MAGNUM) For Its Upcoming Dividend

Magnum Berhad (KLSE:MAGNUM) stock is about to trade ex-dividend in 3 days. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. This means that investors who purchase Magnum Berhad's shares on or after the 5th of December will not receive the dividend, which will be paid on the 18th of December.

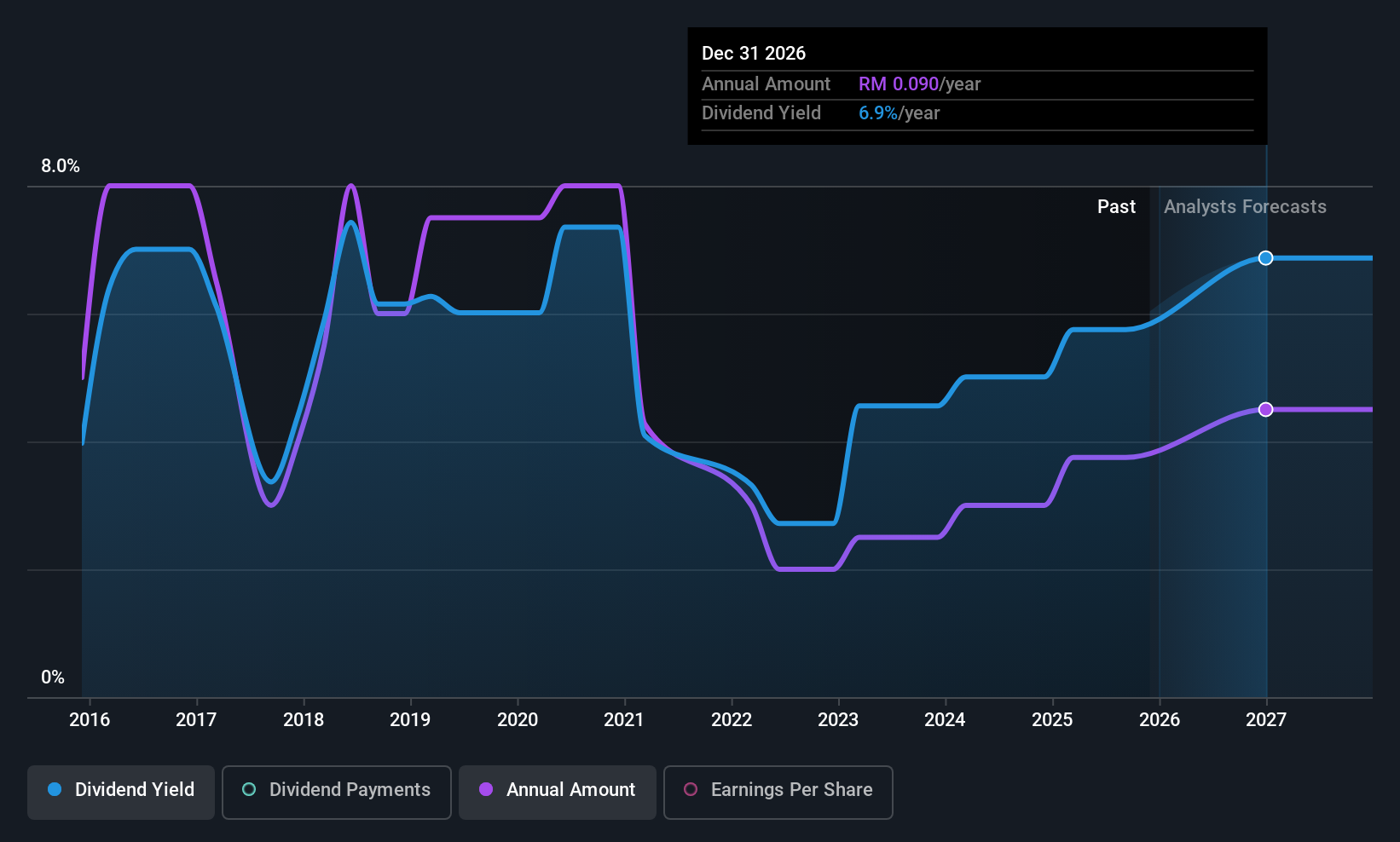

The company's upcoming dividend is RM00.02 a share, following on from the last 12 months, when the company distributed a total of RM0.075 per share to shareholders. Based on the last year's worth of payments, Magnum Berhad has a trailing yield of 5.7% on the current stock price of RM01.31. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Magnum Berhad paid out more than half (72%) of its earnings last year, which is a regular payout ratio for most companies. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out more than half (66%) of its free cash flow in the past year, which is within an average range for most companies.

It's positive to see that Magnum Berhad's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

See our latest analysis for Magnum Berhad

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's not ideal to see Magnum Berhad's earnings per share have been shrinking at 4.8% a year over the previous five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Magnum Berhad's dividend payments per share have declined at 9.3% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

The Bottom Line

Should investors buy Magnum Berhad for the upcoming dividend? While earnings per share are shrinking, it's encouraging to see that at least Magnum Berhad's dividend appears sustainable, with earnings and cashflow payout ratios that are within reasonable bounds. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

So if you're still interested in Magnum Berhad despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. To help with this, we've discovered 2 warning signs for Magnum Berhad (1 is a bit concerning!) that you ought to be aware of before buying the shares.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MAGNUM

Magnum Berhad

An investment holding company, engages in the gaming business in Malaysia.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026