- Malaysia

- /

- Hospitality

- /

- KLSE:AVI

A Piece Of The Puzzle Missing From Avillion Berhad's (KLSE:AVI) 50% Share Price Climb

Avillion Berhad (KLSE:AVI) shares have had a really impressive month, gaining 50% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 10.0% in the last twelve months.

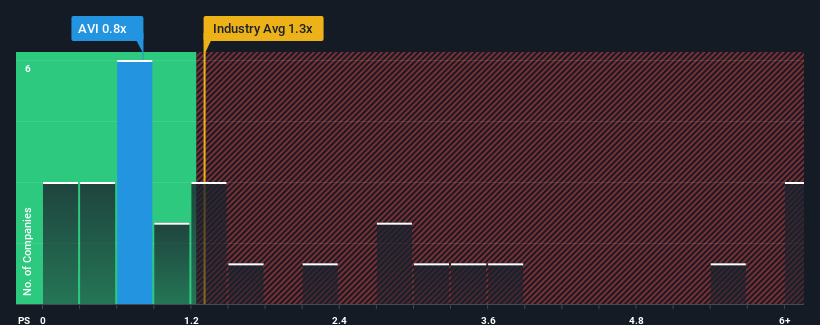

Although its price has surged higher, considering around half the companies operating in Malaysia's Hospitality industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Avillion Berhad as an solid investment opportunity with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Avillion Berhad

How Avillion Berhad Has Been Performing

As an illustration, revenue has deteriorated at Avillion Berhad over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Avillion Berhad will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Avillion Berhad?

Avillion Berhad's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. Even so, admirably revenue has lifted 173% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 7.7% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Avillion Berhad's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Avillion Berhad's P/S?

The latest share price surge wasn't enough to lift Avillion Berhad's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Avillion Berhad revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware Avillion Berhad is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:AVI

Avillion Berhad

An investment holding company, engages in the hotel, property, and travel businesses in Malaysia, Hong Kong, Singapore, and Indonesia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026