- Malaysia

- /

- Food and Staples Retail

- /

- KLSE:KTC

Kim Teck Cheong Consolidated Berhad (KLSE:KTC) Might Have The Makings Of A Multi-Bagger

There are a few key trends to look for if we want to identify the next multi-bagger. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So on that note, Kim Teck Cheong Consolidated Berhad (KLSE:KTC) looks quite promising in regards to its trends of return on capital.

Return On Capital Employed (ROCE): What is it?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Kim Teck Cheong Consolidated Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

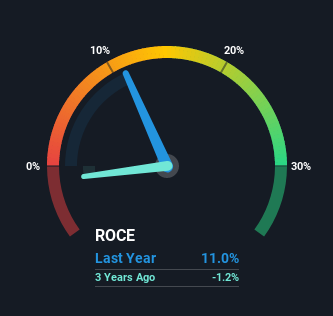

0.11 = RM17m ÷ (RM325m - RM169m) (Based on the trailing twelve months to March 2021).

Thus, Kim Teck Cheong Consolidated Berhad has an ROCE of 11%. On its own, that's a standard return, however it's much better than the 8.4% generated by the Consumer Retailing industry.

Check out our latest analysis for Kim Teck Cheong Consolidated Berhad

Historical performance is a great place to start when researching a stock so above you can see the gauge for Kim Teck Cheong Consolidated Berhad's ROCE against it's prior returns. If you're interested in investigating Kim Teck Cheong Consolidated Berhad's past further, check out this free graph of past earnings, revenue and cash flow.

So How Is Kim Teck Cheong Consolidated Berhad's ROCE Trending?

The trends we've noticed at Kim Teck Cheong Consolidated Berhad are quite reassuring. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 11%. Basically the business is earning more per dollar of capital invested and in addition to that, 64% more capital is being employed now too. So we're very much inspired by what we're seeing at Kim Teck Cheong Consolidated Berhad thanks to its ability to profitably reinvest capital.

On a separate but related note, it's important to know that Kim Teck Cheong Consolidated Berhad has a current liabilities to total assets ratio of 52%, which we'd consider pretty high. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

What We Can Learn From Kim Teck Cheong Consolidated Berhad's ROCE

All in all, it's terrific to see that Kim Teck Cheong Consolidated Berhad is reaping the rewards from prior investments and is growing its capital base. And since the stock has fallen 43% over the last five years, there might be an opportunity here. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

On a separate note, we've found 3 warning signs for Kim Teck Cheong Consolidated Berhad you'll probably want to know about.

While Kim Teck Cheong Consolidated Berhad may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kim Teck Cheong Consolidated Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KTC

Kim Teck Cheong Consolidated Berhad

Engages in distribution and warehousing of consumer packaged goods in East Malaysia and Brunei.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026