- Malaysia

- /

- Hospitality

- /

- KLSE:FOCUS

Announcing: Focus Dynamics Group Berhad (KLSE:FOCUS) Stock Rocketed An Astounding 1078% In The Last Five Years

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. Don't believe it? Then look at the Focus Dynamics Group Berhad (KLSE:FOCUS) share price. It's 1078% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. In more good news, the share price has risen 2.2% in thirty days. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report.

We love happy stories like this one. The company should be really proud of that performance!

View 3 warning signs we detected for Focus Dynamics Group Berhad

Focus Dynamics Group Berhad wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Focus Dynamics Group Berhad saw its revenue grow at 25% per year. Even measured against other revenue-focussed companies, that's a good result. Arguably, this is well and truly reflected in the strong share price gain of 64%(per year) over the same period. Despite the strong run, top performers like Focus Dynamics Group Berhad have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

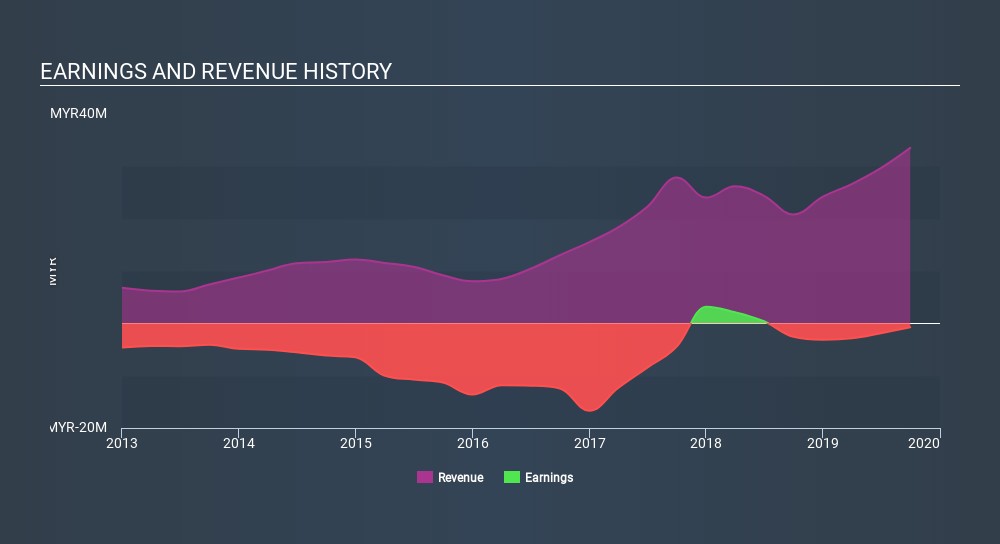

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Focus Dynamics Group Berhad's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Focus Dynamics Group Berhad shareholders have received a total shareholder return of 221% over one year. That gain is better than the annual TSR over five years, which is 64%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Focus Dynamics Group Berhad which any shareholder or potential investor should be aware of.

But note: Focus Dynamics Group Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:FOCUS

Focus Dynamics Group Berhad

An investment holding company, primarily engages in operation and management of food and beverage outlet business in Malaysia and Hong Kong.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026