- Malaysia

- /

- Consumer Durables

- /

- KLSE:WEGMANS

Wegmans Holdings Berhad (KLSE:WEGMANS) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Wegmans Holdings Berhad (KLSE:WEGMANS) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Wegmans Holdings Berhad

What Is Wegmans Holdings Berhad's Net Debt?

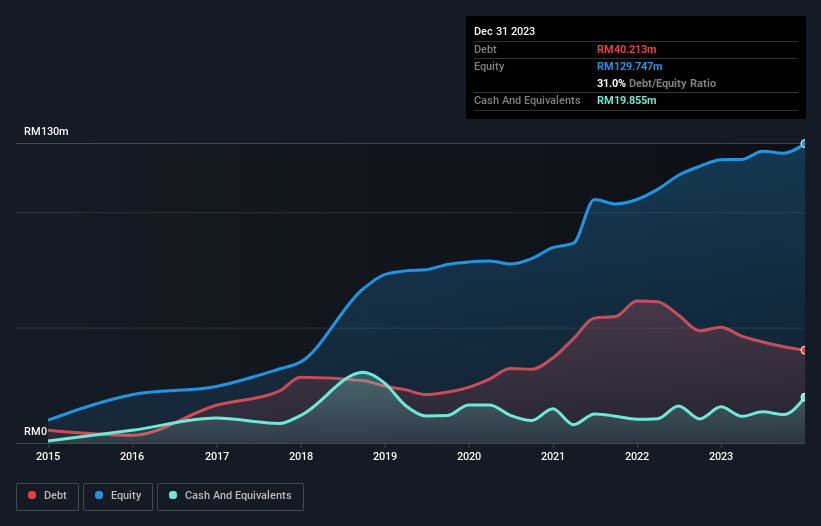

As you can see below, Wegmans Holdings Berhad had RM40.2m of debt at December 2023, down from RM50.2m a year prior. However, it does have RM19.9m in cash offsetting this, leading to net debt of about RM20.4m.

How Strong Is Wegmans Holdings Berhad's Balance Sheet?

The latest balance sheet data shows that Wegmans Holdings Berhad had liabilities of RM27.9m due within a year, and liabilities of RM31.3m falling due after that. Offsetting this, it had RM19.9m in cash and RM14.3m in receivables that were due within 12 months. So its liabilities total RM25.0m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Wegmans Holdings Berhad is worth RM112.6m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Wegmans Holdings Berhad's low debt to EBITDA ratio of 1.4 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 4.6 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Shareholders should be aware that Wegmans Holdings Berhad's EBIT was down 81% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Wegmans Holdings Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Wegmans Holdings Berhad reported free cash flow worth 14% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Mulling over Wegmans Holdings Berhad's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But at least it's pretty decent at managing its debt, based on its EBITDA,; that's encouraging. Once we consider all the factors above, together, it seems to us that Wegmans Holdings Berhad's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Wegmans Holdings Berhad is showing 3 warning signs in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Wegmans Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WEGMANS

Wegmans Holdings Berhad

An investment holding company, designs, manufactures, and sells home furniture products in Africa, rest of Asia, Australasia, Europe, North America, South America, and Malaysia.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives