Techbase Industries Berhad (KLSE:TECHBASE) Has Debt But No Earnings; Should You Worry?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Techbase Industries Berhad (KLSE:TECHBASE) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Techbase Industries Berhad

What Is Techbase Industries Berhad's Debt?

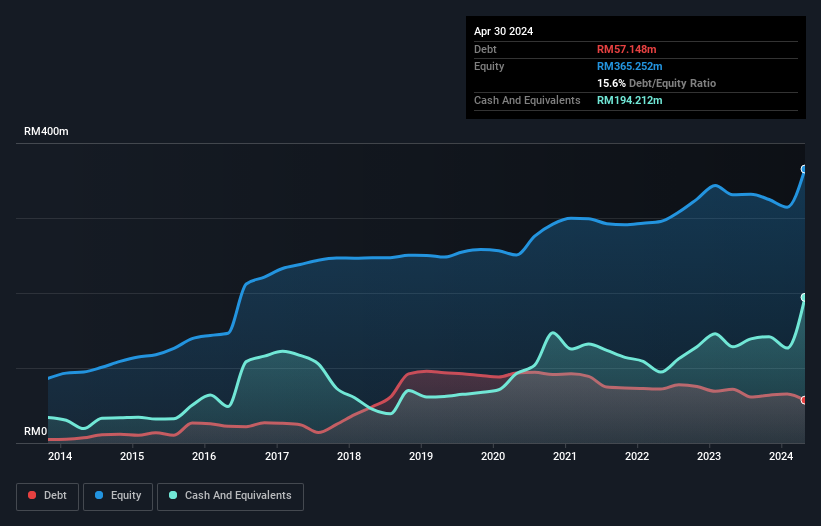

As you can see below, Techbase Industries Berhad had RM57.1m of debt at April 2024, down from RM71.8m a year prior. However, it does have RM194.2m in cash offsetting this, leading to net cash of RM137.1m.

How Strong Is Techbase Industries Berhad's Balance Sheet?

The latest balance sheet data shows that Techbase Industries Berhad had liabilities of RM47.3m due within a year, and liabilities of RM31.4m falling due after that. Offsetting these obligations, it had cash of RM194.2m as well as receivables valued at RM42.5m due within 12 months. So it can boast RM158.0m more liquid assets than total liabilities.

This surplus strongly suggests that Techbase Industries Berhad has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Techbase Industries Berhad boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Techbase Industries Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Techbase Industries Berhad had a loss before interest and tax, and actually shrunk its revenue by 14%, to RM201m. We would much prefer see growth.

So How Risky Is Techbase Industries Berhad?

While Techbase Industries Berhad lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow RM31m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. The next few years will be important as the business matures. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Techbase Industries Berhad (of which 1 is concerning!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Techbase Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:TECHBASE

Techbase Industries Berhad

An investment holding company, operates in apparel business in Malaysia, the United States, Europe, Asia, and internationally.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026