Is Poh Kong Holdings Berhad (KLSE:POHKONG) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Poh Kong Holdings Berhad (KLSE:POHKONG) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Poh Kong Holdings Berhad

What Is Poh Kong Holdings Berhad's Debt?

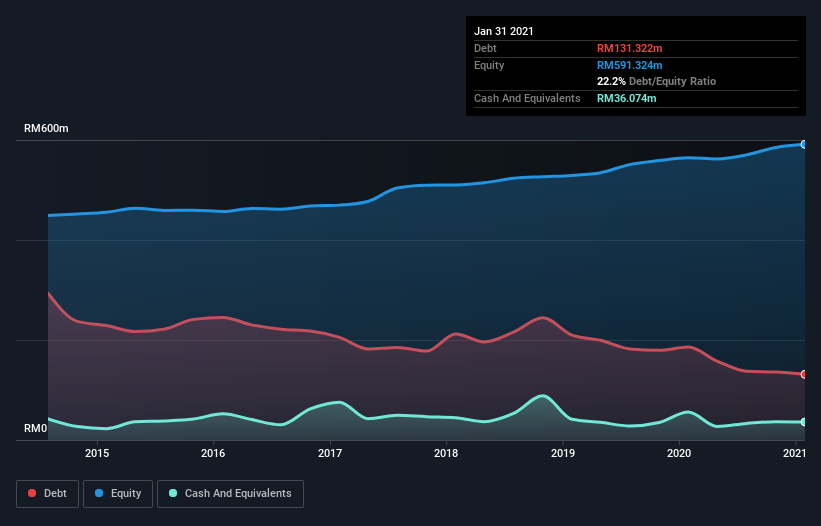

You can click the graphic below for the historical numbers, but it shows that Poh Kong Holdings Berhad had RM131.3m of debt in January 2021, down from RM185.8m, one year before. On the flip side, it has RM36.1m in cash leading to net debt of about RM95.2m.

How Healthy Is Poh Kong Holdings Berhad's Balance Sheet?

According to the last reported balance sheet, Poh Kong Holdings Berhad had liabilities of RM153.8m due within 12 months, and liabilities of RM71.2m due beyond 12 months. Offsetting this, it had RM36.1m in cash and RM6.08m in receivables that were due within 12 months. So it has liabilities totalling RM182.8m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Poh Kong Holdings Berhad has a market capitalization of RM363.2m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With a debt to EBITDA ratio of 1.5, Poh Kong Holdings Berhad uses debt artfully but responsibly. And the fact that its trailing twelve months of EBIT was 7.1 times its interest expenses harmonizes with that theme. While Poh Kong Holdings Berhad doesn't seem to have gained much on the EBIT line, at least earnings remain stable for now. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Poh Kong Holdings Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Poh Kong Holdings Berhad actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

On our analysis Poh Kong Holdings Berhad's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. For example, its level of total liabilities makes us a little nervous about its debt. When we consider all the elements mentioned above, it seems to us that Poh Kong Holdings Berhad is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Poh Kong Holdings Berhad has 1 warning sign we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:POHKONG

Poh Kong Holdings Berhad

An investment holding company, manufactures, trades in, and retails jewelry, bullion, precious and semi-precious stones, and gold ornaments primarily in Malaysia.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success