Increases to CEO Compensation Might Be Put On Hold For Now at Poh Kong Holdings Berhad (KLSE:POHKONG)

Key Insights

- Poh Kong Holdings Berhad's Annual General Meeting to take place on 30th of January

- Total pay for CEO Eddie Choon includes RM1.78m salary

- Total compensation is 629% above industry average

- Over the past three years, Poh Kong Holdings Berhad's EPS grew by 38% and over the past three years, the total shareholder return was 9.9%

Under the guidance of CEO Eddie Choon, Poh Kong Holdings Berhad (KLSE:POHKONG) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 30th of January. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Poh Kong Holdings Berhad

Comparing Poh Kong Holdings Berhad's CEO Compensation With The Industry

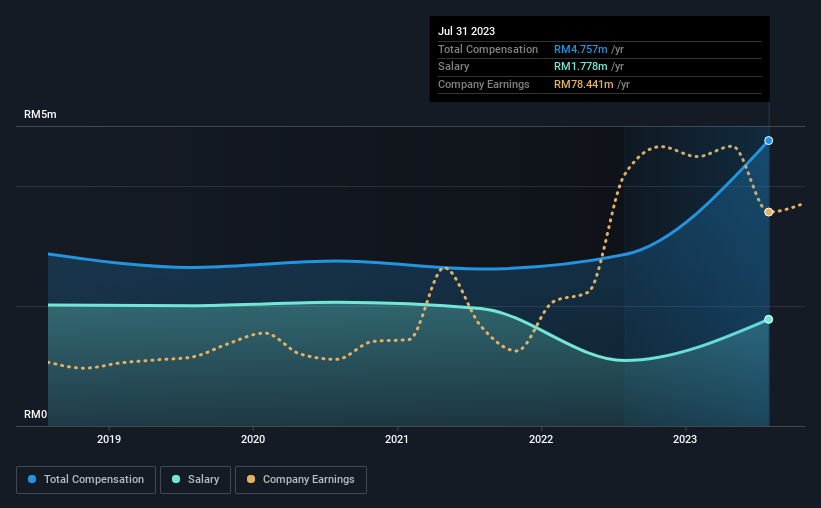

At the time of writing, our data shows that Poh Kong Holdings Berhad has a market capitalization of RM351m, and reported total annual CEO compensation of RM4.8m for the year to July 2023. Notably, that's an increase of 67% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at RM1.8m.

In comparison with other companies in the Malaysia Luxury industry with market capitalizations under RM945m, the reported median total CEO compensation was RM652k. Hence, we can conclude that Eddie Choon is remunerated higher than the industry median. Furthermore, Eddie Choon directly owns RM9.9m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM1.8m | RM1.1m | 37% |

| Other | RM3.0m | RM1.8m | 63% |

| Total Compensation | RM4.8m | RM2.9m | 100% |

Talking in terms of the industry, salary represented approximately 65% of total compensation out of all the companies we analyzed, while other remuneration made up 35% of the pie. Poh Kong Holdings Berhad pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Poh Kong Holdings Berhad's Growth Numbers

Over the past three years, Poh Kong Holdings Berhad has seen its earnings per share (EPS) grow by 38% per year. It saw its revenue drop 6.5% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Poh Kong Holdings Berhad Been A Good Investment?

Poh Kong Holdings Berhad has generated a total shareholder return of 9.9% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 2 warning signs for Poh Kong Holdings Berhad that investors should look into moving forward.

Important note: Poh Kong Holdings Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:POHKONG

Poh Kong Holdings Berhad

An investment holding company, manufactures, trades in, and retails jewelry, bullion, precious and semi-precious stones, and gold ornaments primarily in Malaysia.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success