David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Lee Swee Kiat Group Berhad (KLSE:LEESK) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Lee Swee Kiat Group Berhad

How Much Debt Does Lee Swee Kiat Group Berhad Carry?

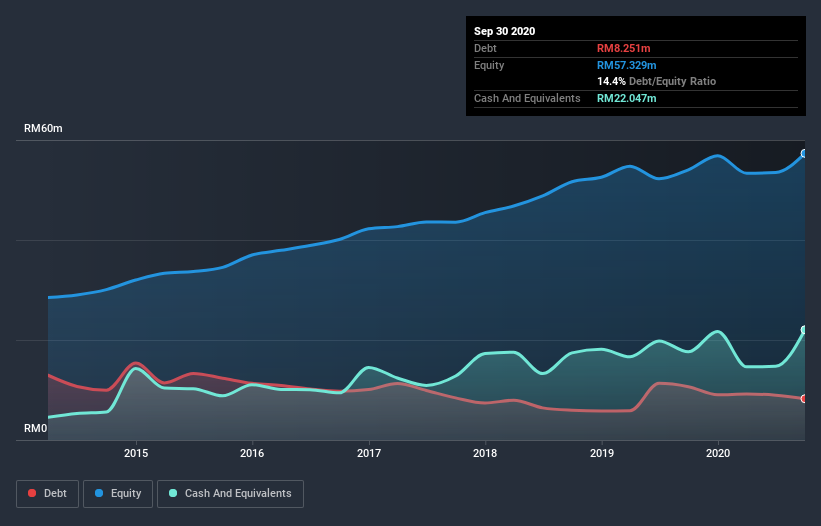

The image below, which you can click on for greater detail, shows that Lee Swee Kiat Group Berhad had debt of RM8.25m at the end of September 2020, a reduction from RM10.7m over a year. But it also has RM22.0m in cash to offset that, meaning it has RM13.8m net cash.

How Healthy Is Lee Swee Kiat Group Berhad's Balance Sheet?

According to the last reported balance sheet, Lee Swee Kiat Group Berhad had liabilities of RM26.5m due within 12 months, and liabilities of RM8.30m due beyond 12 months. Offsetting these obligations, it had cash of RM22.0m as well as receivables valued at RM11.3m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM1.45m.

This state of affairs indicates that Lee Swee Kiat Group Berhad's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the RM140.7m company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, Lee Swee Kiat Group Berhad boasts net cash, so it's fair to say it does not have a heavy debt load!

While Lee Swee Kiat Group Berhad doesn't seem to have gained much on the EBIT line, at least earnings remain stable for now. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Lee Swee Kiat Group Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Lee Swee Kiat Group Berhad may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Lee Swee Kiat Group Berhad generated free cash flow amounting to a very robust 97% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Summing up

We could understand if investors are concerned about Lee Swee Kiat Group Berhad's liabilities, but we can be reassured by the fact it has has net cash of RM13.8m. And it impressed us with free cash flow of RM21m, being 97% of its EBIT. So is Lee Swee Kiat Group Berhad's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - Lee Swee Kiat Group Berhad has 3 warning signs we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Lee Swee Kiat Group Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:LEESK

Lee Swee Kiat Group Berhad

An investment holding company, engages in manufacturing, retail, trading, and distribution of mattresses and bedding accessories primarily in Malaysia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success