- Malaysia

- /

- Professional Services

- /

- KLSE:SCICOM

We Think Scicom (MSC) Berhad's (KLSE:SCICOM) CEO Compensation Package Needs To Be Put Under A Microscope

Key Insights

- Scicom (MSC) Berhad to hold its Annual General Meeting on 11th of December

- Total pay for CEO Leo Ariyanayakam includes RM1.22m salary

- The overall pay is 386% above the industry average

- Over the past three years, Scicom (MSC) Berhad's EPS fell by 2.8% and over the past three years, the total loss to shareholders 8.3%

Scicom (MSC) Berhad (KLSE:SCICOM) has not performed well recently and CEO Leo Ariyanayakam will probably need to up their game. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 11th of December. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. We present the case why we think CEO compensation is out of sync with company performance.

See our latest analysis for Scicom (MSC) Berhad

Comparing Scicom (MSC) Berhad's CEO Compensation With The Industry

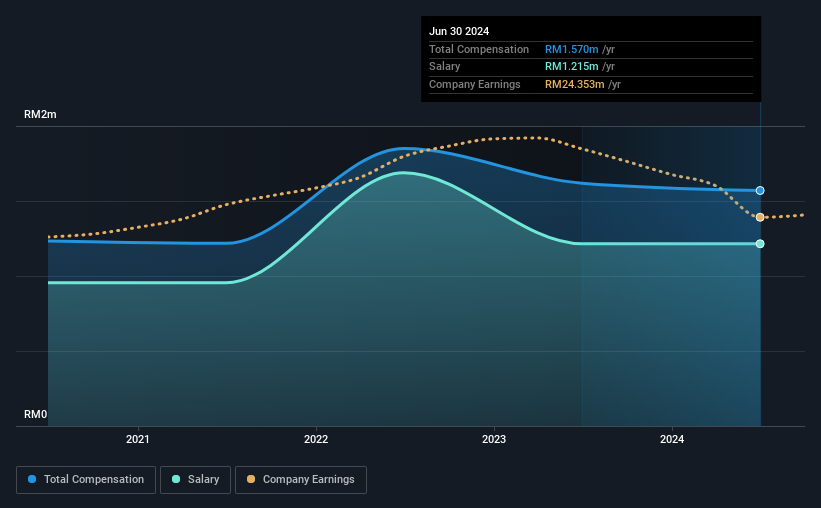

Our data indicates that Scicom (MSC) Berhad has a market capitalization of RM307m, and total annual CEO compensation was reported as RM1.6m for the year to June 2024. That's slightly lower by 3.0% over the previous year. We note that the salary portion, which stands at RM1.22m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Malaysia Professional Services industry with market capitalizations below RM891m, reported a median total CEO compensation of RM323k. Accordingly, our analysis reveals that Scicom (MSC) Berhad pays Leo Ariyanayakam north of the industry median. Furthermore, Leo Ariyanayakam directly owns RM80m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | RM1.2m | RM1.2m | 77% |

| Other | RM355k | RM404k | 23% |

| Total Compensation | RM1.6m | RM1.6m | 100% |

On an industry level, roughly 89% of total compensation represents salary and 11% is other remuneration. Scicom (MSC) Berhad sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Scicom (MSC) Berhad's Growth Numbers

Over the last three years, Scicom (MSC) Berhad has shrunk its earnings per share by 2.8% per year. Its revenue is down 8.1% over the previous year.

Its a bit disappointing to see that the company has failed to grow its EPS. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Scicom (MSC) Berhad Been A Good Investment?

Since shareholders would have lost about 8.3% over three years, some Scicom (MSC) Berhad investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Scicom (MSC) Berhad that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SCICOM

Scicom (MSC) Berhad

An investment holding company that provides customer contact center outsourcing services in Malaysia, the Philippines, Singapore, Hong Kong, Sri Lanka, Thailand, Germany, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026