Stock Analysis

- Malaysia

- /

- Commercial Services

- /

- KLSE:PICORP

Progressive Impact Corporation Berhad (KLSE:PICORP) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Progressive Impact Corporation Berhad (KLSE:PICORP) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Progressive Impact Corporation Berhad

What Is Progressive Impact Corporation Berhad's Debt?

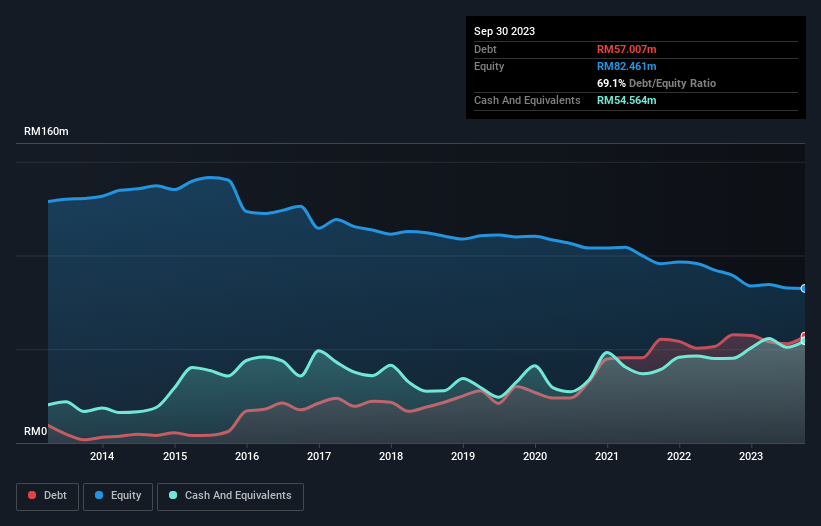

As you can see below, Progressive Impact Corporation Berhad had RM57.0m of debt, at September 2023, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of RM54.6m, its net debt is less, at about RM2.44m.

How Healthy Is Progressive Impact Corporation Berhad's Balance Sheet?

According to the last reported balance sheet, Progressive Impact Corporation Berhad had liabilities of RM93.5m due within 12 months, and liabilities of RM7.05m due beyond 12 months. On the other hand, it had cash of RM54.6m and RM41.4m worth of receivables due within a year. So its liabilities total RM4.57m more than the combination of its cash and short-term receivables.

Given Progressive Impact Corporation Berhad has a market capitalization of RM55.7m, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Progressive Impact Corporation Berhad has a very low debt to EBITDA ratio of 0.22 so it is strange to see weak interest coverage, with last year's EBIT being only 0.85 times the interest expense. So while we're not necessarily alarmed we think that its debt is far from trivial. Shareholders should be aware that Progressive Impact Corporation Berhad's EBIT was down 68% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Progressive Impact Corporation Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Progressive Impact Corporation Berhad actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

We weren't impressed with Progressive Impact Corporation Berhad's interest cover, and its EBIT growth rate made us cautious. But its conversion of EBIT to free cash flow was significantly redeeming. When we consider all the factors mentioned above, we do feel a bit cautious about Progressive Impact Corporation Berhad's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Progressive Impact Corporation Berhad you should be aware of, and 1 of them is significant.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're helping make it simple.

Find out whether Progressive Impact Corporation Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About KLSE:PICORP

Progressive Impact Corporation Berhad

Progressive Impact Corporation Berhad, an investment holding company, provides environmental consulting, monitoring, monitoring equipment and systems integration, environmental data management and laboratory testing services, and wastewater treatment solutions in Malaysia, Indonesia, and Saudi Arabia.

Good value with adequate balance sheet.