- Malaysia

- /

- Commercial Services

- /

- KLSE:MTAG

Announcing: MTAG Group Berhad (KLSE:MTAG) Stock Increased An Energizing 114% In The Last Year

It might be of some concern to shareholders to see the MTAG Group Berhad (KLSE:MTAG) share price down 12% in the last month. But that doesn't detract from the splendid returns of the last year. Indeed, the share price is up an impressive 114% in that time. So we think most shareholders won't be too upset about the recent fall. More important, going forward, is how the business itself is going.

View our latest analysis for MTAG Group Berhad

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, MTAG Group Berhad actually saw its earnings per share drop 99%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We note that the most recent dividend payment is higher than the payment a year ago, so that may have assisted the share price. Income-seeking investors probably helped bid up the stock price.

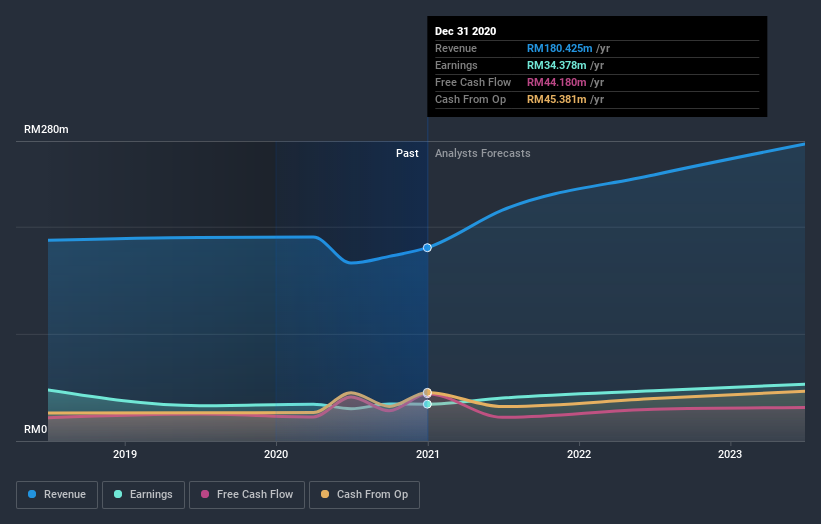

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at MTAG Group Berhad's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for MTAG Group Berhad the TSR over the last year was 125%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

MTAG Group Berhad shareholders should be happy with the total gain of 125% over the last twelve months, including dividends. We regret to report that the share price is down 3.2% over ninety days. Shorter term share price moves often don't signify much about the business itself. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - MTAG Group Berhad has 1 warning sign we think you should be aware of.

But note: MTAG Group Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade MTAG Group Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MTAG

MTAG Group Berhad

An investment holding company, provides labels and stickers printing, and material converting services primarily in Malaysia and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives