- Malaysia

- /

- Construction

- /

- KLSE:WESTRVR

Not Many Are Piling Into West River Berhad (KLSE:WESTRVR) Just Yet

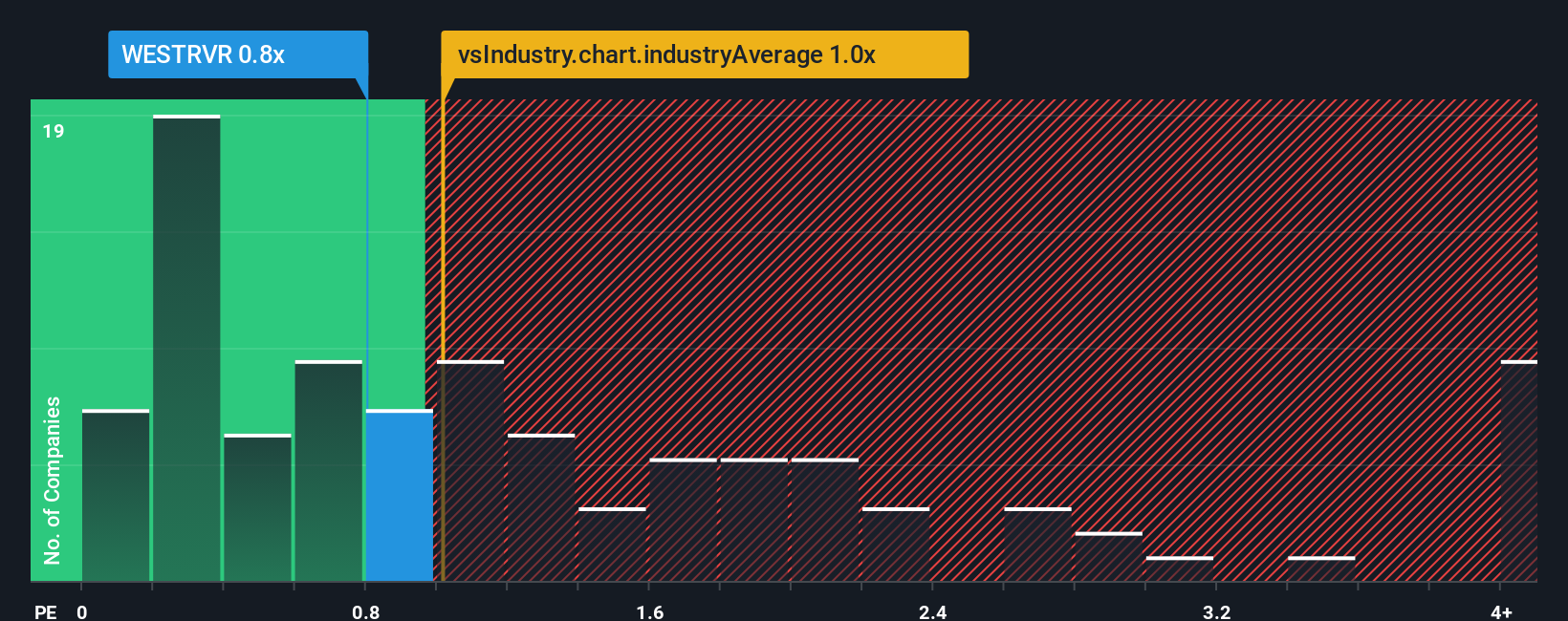

With a median price-to-sales (or "P/S") ratio of close to 1x in the Construction industry in Malaysia, you could be forgiven for feeling indifferent about West River Berhad's (KLSE:WESTRVR) P/S ratio of 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for West River Berhad

How Has West River Berhad Performed Recently?

West River Berhad could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on West River Berhad.How Is West River Berhad's Revenue Growth Trending?

In order to justify its P/S ratio, West River Berhad would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.0%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 122% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 13% per year over the next three years. With the industry only predicted to deliver 11% per year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that West River Berhad's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does West River Berhad's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, West River Berhad's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 3 warning signs for West River Berhad (1 is potentially serious!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

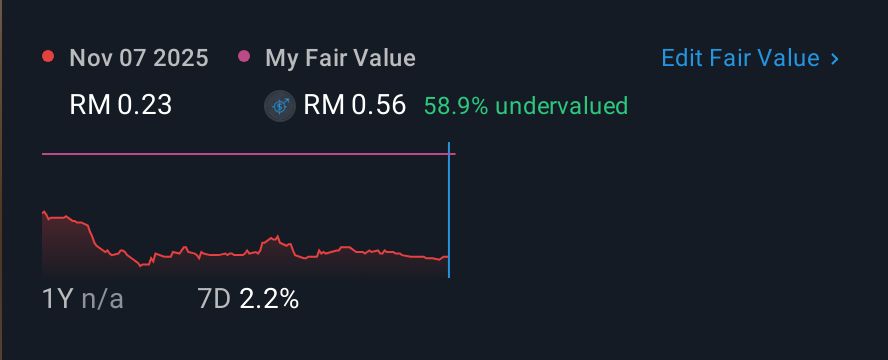

Valuation is complex, but we're here to simplify it.

Discover if West River Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WESTRVR

West River Berhad

An investment holding company, provides mechanical and electrical engineering services in Malaysia.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives