- Malaysia

- /

- Construction

- /

- KLSE:WCT

Unpleasant Surprises Could Be In Store For WCT Holdings Berhad's (KLSE:WCT) Shares

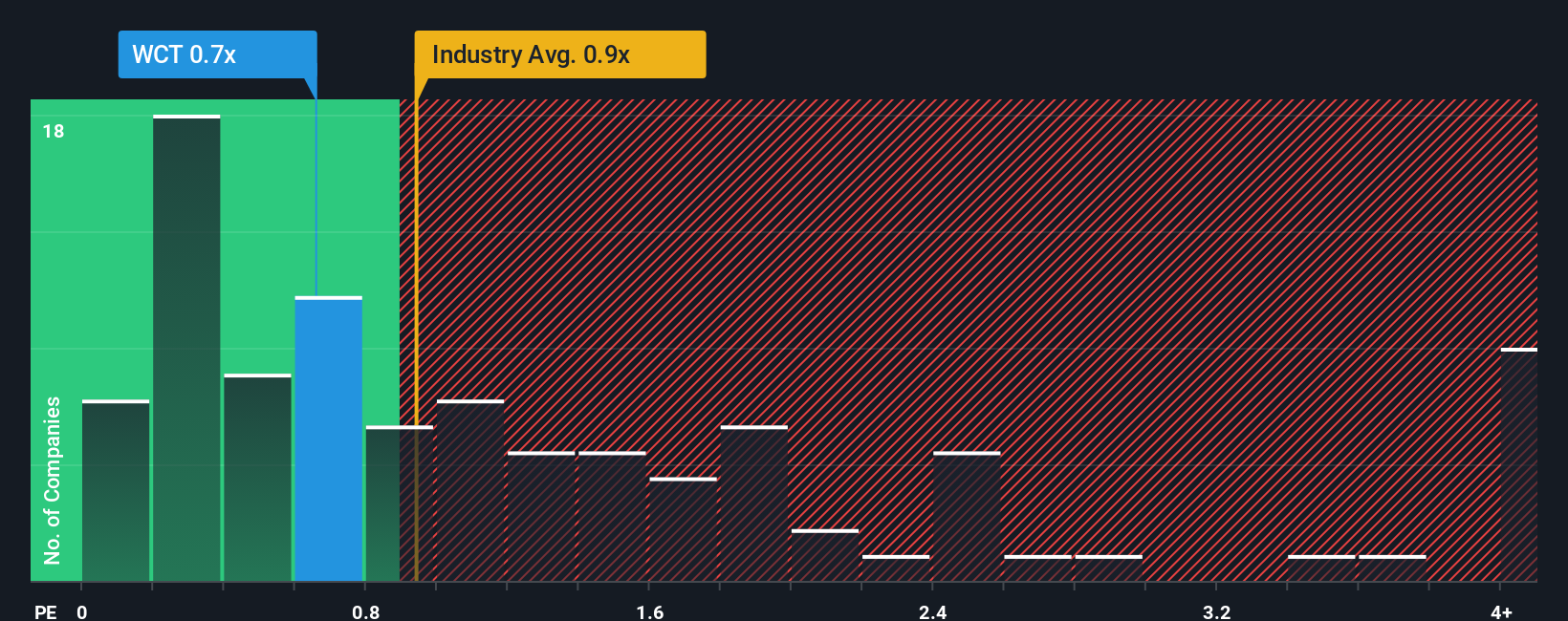

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Construction industry in Malaysia, you could be forgiven for feeling indifferent about WCT Holdings Berhad's (KLSE:WCT) P/S ratio of 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for WCT Holdings Berhad

How WCT Holdings Berhad Has Been Performing

WCT Holdings Berhad could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think WCT Holdings Berhad's future stacks up against the industry? In that case, our free report is a great place to start.How Is WCT Holdings Berhad's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like WCT Holdings Berhad's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.7% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 1.1% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 7.3% as estimated by the six analysts watching the company. That's shaping up to be materially lower than the 23% growth forecast for the broader industry.

In light of this, it's curious that WCT Holdings Berhad's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that WCT Holdings Berhad's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You need to take note of risks, for example - WCT Holdings Berhad has 3 warning signs (and 2 which are concerning) we think you should know about.

If you're unsure about the strength of WCT Holdings Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if WCT Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WCT

WCT Holdings Berhad

An investment holding company, engages in the engineering and construction, property development, and property investment and management activities in Malaysia, the Middle East, India, and internationally.

Undervalued low.

Similar Companies

Market Insights

Community Narratives