- Malaysia

- /

- Electrical

- /

- KLSE:TRIVE

Investors Who Bought Trive Property Group Berhad (KLSE:TRIVE) Shares Three Years Ago Are Now Down 91%

Trive Property Group Berhad (KLSE:TRIVE) shareholders are doubtless heartened to see the share price bounce 100% in just one week. But that is meagre solace in the face of the shocking decline over three years. In that time the share price has melted like a snowball in the desert, down 91%. So it sure is nice to see a big of an improvement. Of course the real question is whether the business can sustain a turnaround.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Trive Property Group Berhad

We don't think Trive Property Group Berhad's revenue of RM3,926,000 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. Investors will be hoping that Trive Property Group Berhad can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Trive Property Group Berhad investors have already had a taste of the bitterness stocks like this can leave in the mouth.

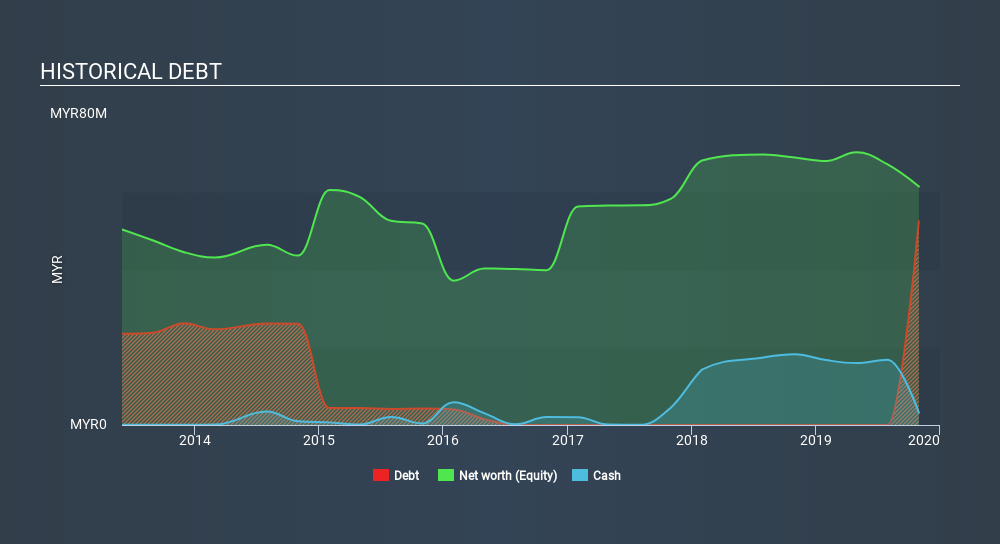

Trive Property Group Berhad had liabilities exceeding cash by RM78m when it last reported in October 2019, according to our data. That makes it extremely high risk, in our view. But with the share price diving 55% per year, over 3 years , it's probably fair to say that some shareholders no longer believe the company will succeed. You can see in the image below, how Trive Property Group Berhad's cash levels have changed over time (click to see the values). The image below shows how Trive Property Group Berhad's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

While the broader market lost about 13% in the twelve months, Trive Property Group Berhad shareholders did even worse, losing 33%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 36% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Trive Property Group Berhad better, we need to consider many other factors. Case in point: We've spotted 5 warning signs for Trive Property Group Berhad you should be aware of, and 3 of them are a bit concerning.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:TRIVE

Trive Property Group Berhad

An investment holding company, engages in the design, marketing, and trading of battery management systems for rechargeable energy storage solutions in Malaysia and Singapore.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives