- Malaysia

- /

- Industrials

- /

- KLSE:TEXCHEM

It's A Story Of Risk Vs Reward With Texchem Resources Bhd (KLSE:TEXCHEM)

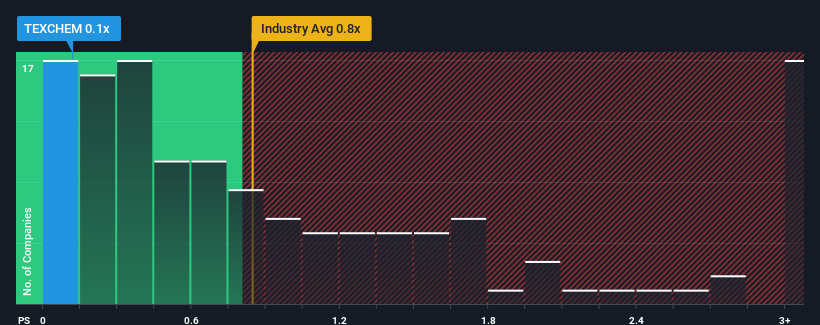

Texchem Resources Bhd's (KLSE:TEXCHEM) price-to-sales (or "P/S") ratio of 0.1x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Industrials industry in Malaysia have P/S ratios greater than 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Texchem Resources Bhd

How Texchem Resources Bhd Has Been Performing

Texchem Resources Bhd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Texchem Resources Bhd.Is There Any Revenue Growth Forecasted For Texchem Resources Bhd?

The only time you'd be truly comfortable seeing a P/S as low as Texchem Resources Bhd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 3.2% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 9.9% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 4.3%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Texchem Resources Bhd's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Texchem Resources Bhd's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Texchem Resources Bhd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Texchem Resources Bhd that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Texchem Resources Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TEXCHEM

Texchem Resources Bhd

An investment holding company, engages in industrial, polymer engineering, food, restaurant, and venture businesses.

Undervalued with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026