SKB Shutters Corporation Berhad's (KLSE:SKBSHUT) Business And Shares Still Trailing The Market

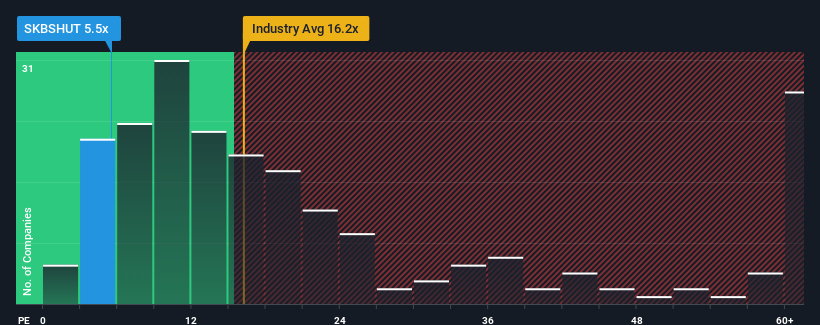

When close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") above 16x, you may consider SKB Shutters Corporation Berhad (KLSE:SKBSHUT) as a highly attractive investment with its 5.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been quite advantageous for SKB Shutters Corporation Berhad as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for SKB Shutters Corporation Berhad

Is There Any Growth For SKB Shutters Corporation Berhad?

There's an inherent assumption that a company should far underperform the market for P/E ratios like SKB Shutters Corporation Berhad's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 35% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 15% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that SKB Shutters Corporation Berhad's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of SKB Shutters Corporation Berhad revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for SKB Shutters Corporation Berhad that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SKBSHUT

SKB Shutters Corporation Berhad

An investment holding company, engages in the manufacture, sale, and trade of roller shutters, racking systems, storage systems, and related steel products in Malaysia, Asia, Oceania, the Middle East, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives