Stock Analysis

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Speaking of which, we noticed some great changes in Sarawak Consolidated Industries Berhad's (KLSE:SCIB) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Sarawak Consolidated Industries Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

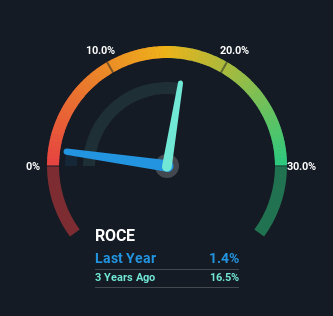

0.014 = RM2.4m ÷ (RM252m - RM77m) (Based on the trailing twelve months to September 2023).

Thus, Sarawak Consolidated Industries Berhad has an ROCE of 1.4%. In absolute terms, that's a low return and it also under-performs the Building industry average of 11%.

View our latest analysis for Sarawak Consolidated Industries Berhad

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Sarawak Consolidated Industries Berhad, check out these free graphs here.

The Trend Of ROCE

We're delighted to see that Sarawak Consolidated Industries Berhad is reaping rewards from its investments and is now generating some pre-tax profits. Shareholders would no doubt be pleased with this because the business was loss-making five years ago but is is now generating 1.4% on its capital. And unsurprisingly, like most companies trying to break into the black, Sarawak Consolidated Industries Berhad is utilizing 173% more capital than it was five years ago. This can tell us that the company has plenty of reinvestment opportunities that are able to generate higher returns.

What We Can Learn From Sarawak Consolidated Industries Berhad's ROCE

In summary, it's great to see that Sarawak Consolidated Industries Berhad has managed to break into profitability and is continuing to reinvest in its business. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

If you want to know some of the risks facing Sarawak Consolidated Industries Berhad we've found 5 warning signs (3 make us uncomfortable!) that you should be aware of before investing here.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're helping make it simple.

Find out whether Sarawak Consolidated Industries Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About KLSE:SCIB

Sarawak Consolidated Industries Berhad

Sarawak Consolidated Industries Berhad, an investment holding company, engages in the manufacture and sale of concrete products for use in the construction and infrastructure sectors primarily in Malaysia.

Flawless balance sheet and overvalued.