Stock Analysis

- Norway

- /

- Energy Services

- /

- OB:SOFF

Three Growth Companies With High Insider Ownership And Up To 107% Earnings Growth

Reviewed by Simply Wall St

As global markets exhibit mixed signals with record highs in major indices and concerns over manufacturing contraction, investors continue to navigate through a complex economic landscape. In such times, growth companies with high insider ownership can be particularly appealing, as significant insider stakes often reflect confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

| Gaming Innovation Group (OB:GIG) | 13.5% | 36.2% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Calliditas Therapeutics (OM:CALTX) | 10.5% | 52.9% |

| EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

| Vow (OB:VOW) | 31.8% | 97.6% |

Here's a peek at a few of the choices from the screener.

P.I.E. Industrial Berhad (KLSE:PIE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: P.I.E. Industrial Berhad is an investment holding company based in Malaysia that manufactures and sells industrial products, operating across Malaysia, the United States, other Asia Pacific countries, and Europe, with a market capitalization of MYR 2.37 billion.

Operations: The company generates revenue primarily through the manufacturing of industrial products, totaling MYR 1.15 billion.

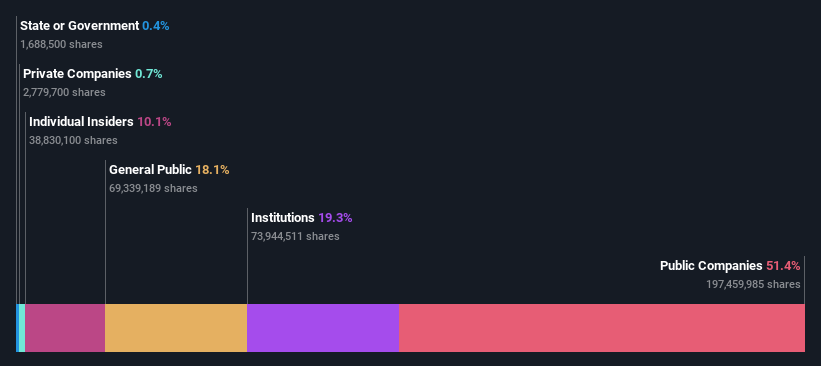

Insider Ownership: 10.1%

Earnings Growth Forecast: 30.7% p.a.

P.I.E. Industrial Berhad, despite a recent dip in quarterly earnings and sales, is positioned for substantial growth with revenue and earnings expected to grow by 30.8% and 30.7% annually, outpacing the Malaysian market averages significantly. This growth trajectory is supported by stable insider ownership with no substantial buying or selling reported over the past three months. However, investors should note the stock’s high volatility in share price during this period.

- Dive into the specifics of P.I.E. Industrial Berhad here with our thorough growth forecast report.

- The analysis detailed in our P.I.E. Industrial Berhad valuation report hints at an deflated share price compared to its estimated value.

Solstad Offshore (OB:SOFF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Solstad Offshore ASA provides offshore service vessels and maritime services to the offshore energy industry, with a market capitalization of NOK 3.49 billion.

Operations: The company generates revenue primarily from its Anchorhandling Vessels (AHTS) segment, which contributed NOK 1.69 billion.

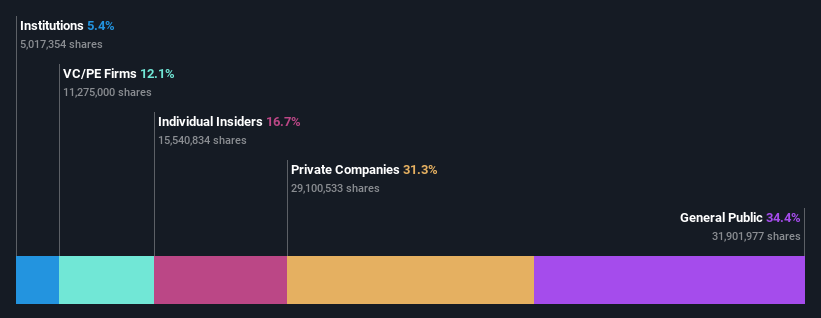

Insider Ownership: 18.2%

Earnings Growth Forecast: 107.9% p.a.

Solstad Offshore ASA, despite a significant drop in Q1 sales and net loss, is trading at 84.2% below estimated fair value, presenting a potential opportunity. The company's earnings are expected to surge by 107.9% annually over the next three years, outperforming the Norwegian market significantly. However, recent legal challenges from Kistefos AS and ongoing high share price volatility may concern investors. Recent substantial contract awards in offshore energy markets signal strong operational momentum.

- Click here to discover the nuances of Solstad Offshore with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Solstad Offshore is trading behind its estimated value.

Gudeng Precision Industrial (TPEX:3680)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gudeng Precision Industrial Co., Ltd. operates globally, offering technology services with a market capitalization of NT$40.45 billion.

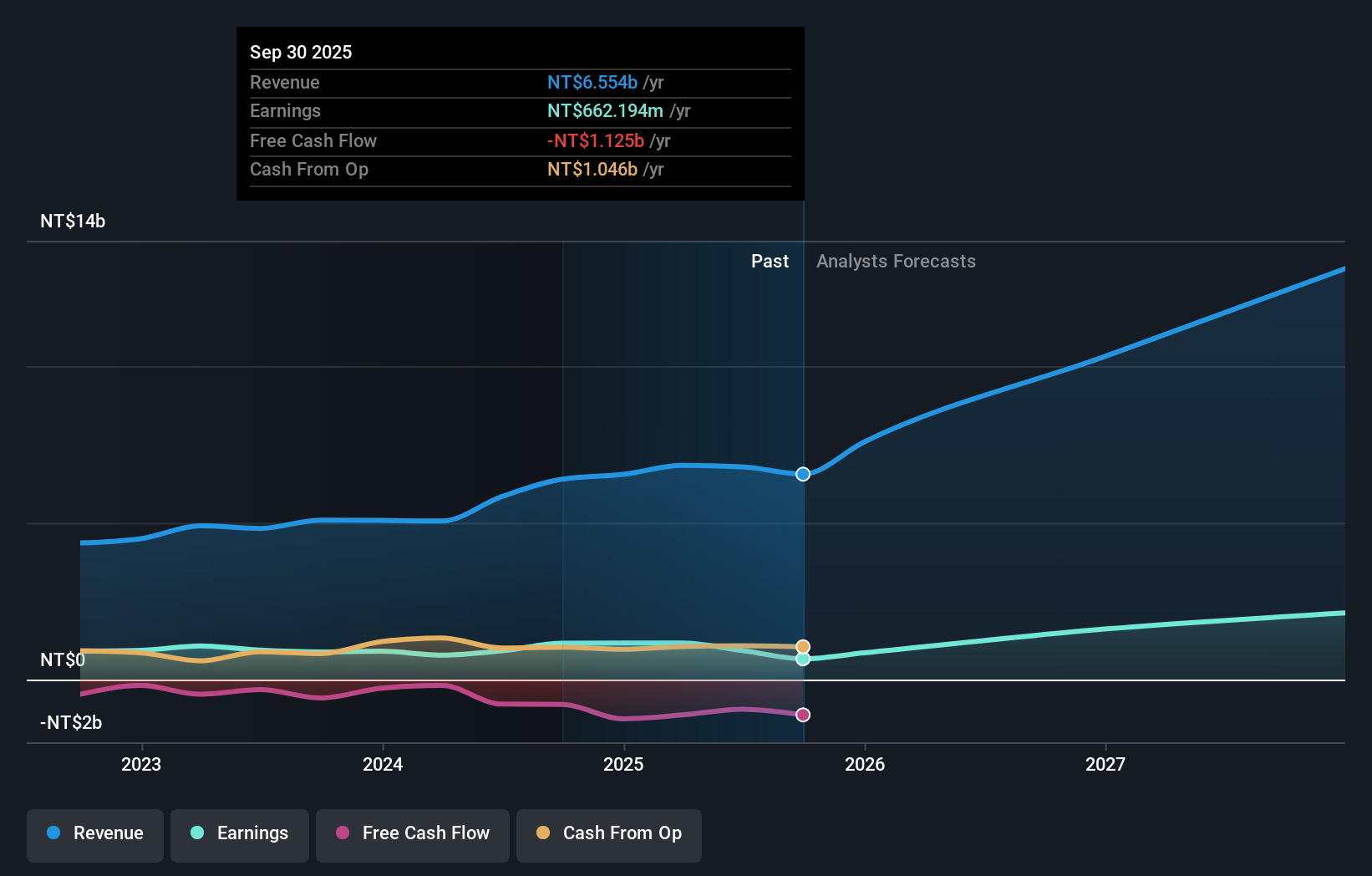

Operations: The company generates revenue primarily from semiconductor manufacturing and equipment manufacturing, totaling NT$3.64 billion and NT$1.28 billion respectively.

Insider Ownership: 29.3%

Earnings Growth Forecast: 37.2% p.a.

Gudeng Precision Industrial Co., Ltd. is expected to see substantial growth, with earnings forecasted to increase by 37.15% annually over the next three years, outpacing the TW market's 17.5% growth rate. Revenue is also projected to grow at 25% per year, exceeding the market average of 11.2%. However, recent financial reports indicate a decline in net income and earnings per share compared to the previous year. The company recently underwent changes in its board and audit committee, which could impact governance and strategic direction.

- Unlock comprehensive insights into our analysis of Gudeng Precision Industrial stock in this growth report.

- According our valuation report, there's an indication that Gudeng Precision Industrial's share price might be on the expensive side.

Make It Happen

- Gain an insight into the universe of 1477 Fast Growing Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Solstad Offshore is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SOFF

Solstad Offshore

Operates offshore service vessels and maritime services to offshore energy industry.

Undervalued with reasonable growth potential.