- Malaysia

- /

- Construction

- /

- KLSE:NESTCON

Some Shareholders Feeling Restless Over Nestcon Berhad's (KLSE:NESTCON) P/E Ratio

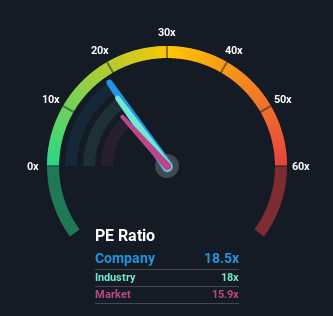

With a price-to-earnings (or "P/E") ratio of 18.5x Nestcon Berhad (KLSE:NESTCON) may be sending bearish signals at the moment, given that almost half of all companies in Malaysia have P/E ratios under 15x and even P/E's lower than 9x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Nestcon Berhad could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Nestcon Berhad

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Nestcon Berhad would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 24%. The last three years don't look nice either as the company has shrunk EPS by 98% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 98% as estimated by the two analysts watching the company. With the market predicted to deliver 15% growth , that's a disappointing outcome.

In light of this, it's alarming that Nestcon Berhad's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

What We Can Learn From Nestcon Berhad's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Nestcon Berhad currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for Nestcon Berhad that you need to take into consideration.

Of course, you might also be able to find a better stock than Nestcon Berhad. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nestcon Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:NESTCON

Nestcon Berhad

An investment holding company, provides construction services in Malaysia.

Solid track record with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Santos: Undervalued After Takeover Fallout

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks