- Malaysia

- /

- Construction

- /

- KLSE:NESTCON

Nestcon Berhad (KLSE:NESTCON) Strong Profits May Be Masking Some Underlying Issues

Nestcon Berhad's (KLSE:NESTCON) robust recent earnings didn't do much to move the stock. We believe that shareholders have noticed some concerning factors beyond the statutory profit numbers.

A Closer Look At Nestcon Berhad's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

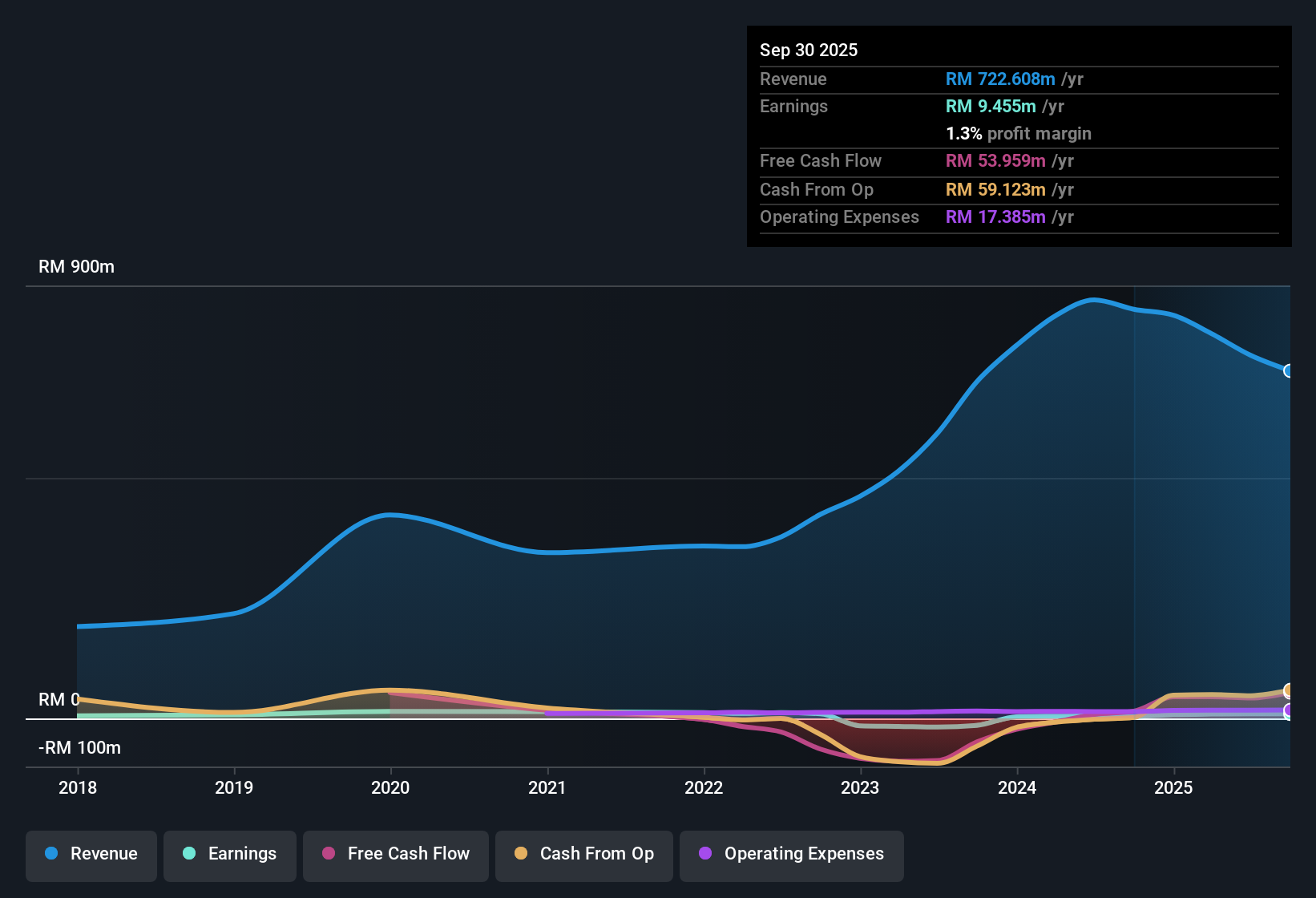

For the year to September 2025, Nestcon Berhad had an accrual ratio of -0.16. That indicates that its free cash flow quite significantly exceeded its statutory profit. Indeed, in the last twelve months it reported free cash flow of RM54m, well over the RM9.46m it reported in profit. Nestcon Berhad shareholders are no doubt pleased that free cash flow improved over the last twelve months. However, that's not the end of the story. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively.

View our latest analysis for Nestcon Berhad

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Nestcon Berhad.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Nestcon Berhad issued 5.8% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Nestcon Berhad's historical EPS growth by clicking on this link.

How Is Dilution Impacting Nestcon Berhad's Earnings Per Share (EPS)?

Unfortunately, we don't have any visibility into its profits three years back, because we lack the data. The good news is that profit was up 117% in the last twelve months. But EPS was less impressive, up only 106% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Nestcon Berhad can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

How Do Unusual Items Influence Profit?

Surprisingly, given Nestcon Berhad's accrual ratio implied strong cash conversion, its paper profit was actually boosted by RM1.6m in unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Nestcon Berhad's Profit Performance

In conclusion, Nestcon Berhad's accrual ratio suggests its earnings are well backed by cash but its boost from unusual items is probably not going to be repeated consistently. Further, the dilution means profits are now split more ways. Based on these factors, we think it's very unlikely that Nestcon Berhad's statutory profits make it seem much weaker than it is. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. When we did our research, we found 3 warning signs for Nestcon Berhad (2 are concerning!) that we believe deserve your full attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Nestcon Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NESTCON

Nestcon Berhad

An investment holding company, provides construction services in Malaysia.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.