- Malaysia

- /

- Construction

- /

- KLSE:MITRA

With EPS Growth And More, Mitrajaya Holdings Berhad (KLSE:MITRA) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Mitrajaya Holdings Berhad (KLSE:MITRA). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Mitrajaya Holdings Berhad

How Quickly Is Mitrajaya Holdings Berhad Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Mitrajaya Holdings Berhad grew its EPS by 14% per year. That growth rate is fairly good, assuming the company can keep it up.

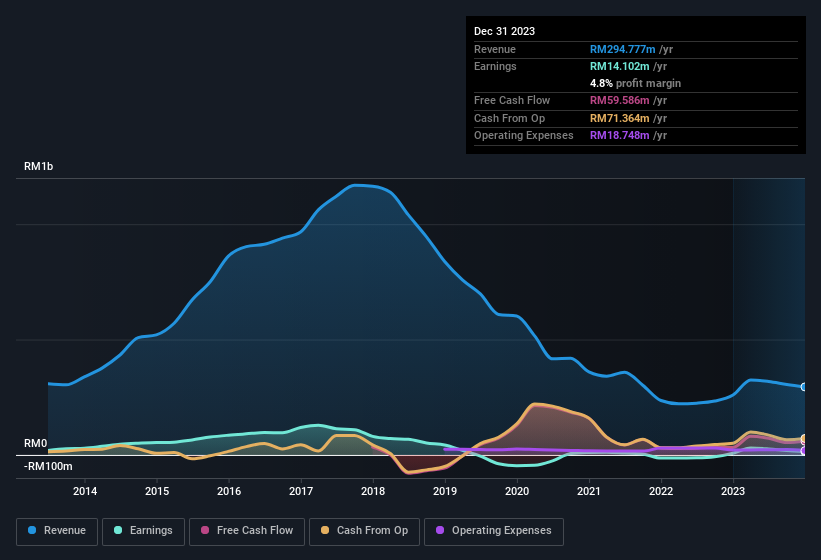

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Mitrajaya Holdings Berhad is growing revenues, and EBIT margins improved by 4.4 percentage points to 8.0%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since Mitrajaya Holdings Berhad is no giant, with a market capitalisation of RM235m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Mitrajaya Holdings Berhad Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Mitrajaya Holdings Berhad insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 63%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. To give you an idea, the value of insiders' holdings in the business are valued at RM148m at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does Mitrajaya Holdings Berhad Deserve A Spot On Your Watchlist?

One positive for Mitrajaya Holdings Berhad is that it is growing EPS. That's nice to see. To add an extra spark to the fire, significant insider ownership in the company is another highlight. The combination definitely favoured by investors so consider keeping the company on a watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Mitrajaya Holdings Berhad that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in MY with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MITRA

Mitrajaya Holdings Berhad

An investment holding company, engages construction and property development businesses in Malaysia and South Africa.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026