The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Mitrajaya Holdings Berhad (KLSE:MITRA) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Mitrajaya Holdings Berhad

How Much Debt Does Mitrajaya Holdings Berhad Carry?

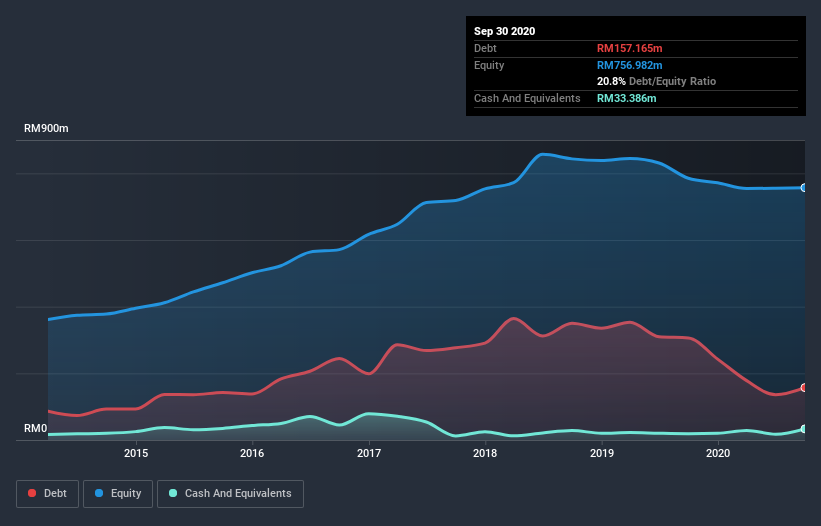

The image below, which you can click on for greater detail, shows that Mitrajaya Holdings Berhad had debt of RM155.4m at the end of September 2020, a reduction from RM306.4m over a year. On the flip side, it has RM33.4m in cash leading to net debt of about RM122.0m.

How Strong Is Mitrajaya Holdings Berhad's Balance Sheet?

The latest balance sheet data shows that Mitrajaya Holdings Berhad had liabilities of RM399.3m due within a year, and liabilities of RM35.6m falling due after that. Offsetting this, it had RM33.4m in cash and RM435.4m in receivables that were due within 12 months. So it actually has RM34.0m more liquid assets than total liabilities.

This excess liquidity suggests that Mitrajaya Holdings Berhad is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Mitrajaya Holdings Berhad's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Mitrajaya Holdings Berhad had a loss before interest and tax, and actually shrunk its revenue by 32%, to RM417m. That makes us nervous, to say the least.

Caveat Emptor

Not only did Mitrajaya Holdings Berhad's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost RM4.2m at the EBIT level. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. And the cherry on top is that its actual free cash flow was RM185m with statutory profit coming in at RM5.8m. This one is a bit too risky for our liking. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Mitrajaya Holdings Berhad you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Mitrajaya Holdings Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MITRA

Mitrajaya Holdings Berhad

An investment holding company, engages construction and property development businesses in Malaysia and South Africa.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026