The 21% return this week takes Kobay Technology Bhd's (KLSE:KOBAY) shareholders five-year gains to 96%

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Kobay Technology Bhd share price has climbed 85% in five years, easily topping the market return of 13% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 16%.

The past week has proven to be lucrative for Kobay Technology Bhd investors, so let's see if fundamentals drove the company's five-year performance.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Kobay Technology Bhd actually saw its EPS drop 20% per year. The impact of extraordinary items on earnings, in the last year, partially explain the diversion.

Essentially, it doesn't seem likely that investors are focused on EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

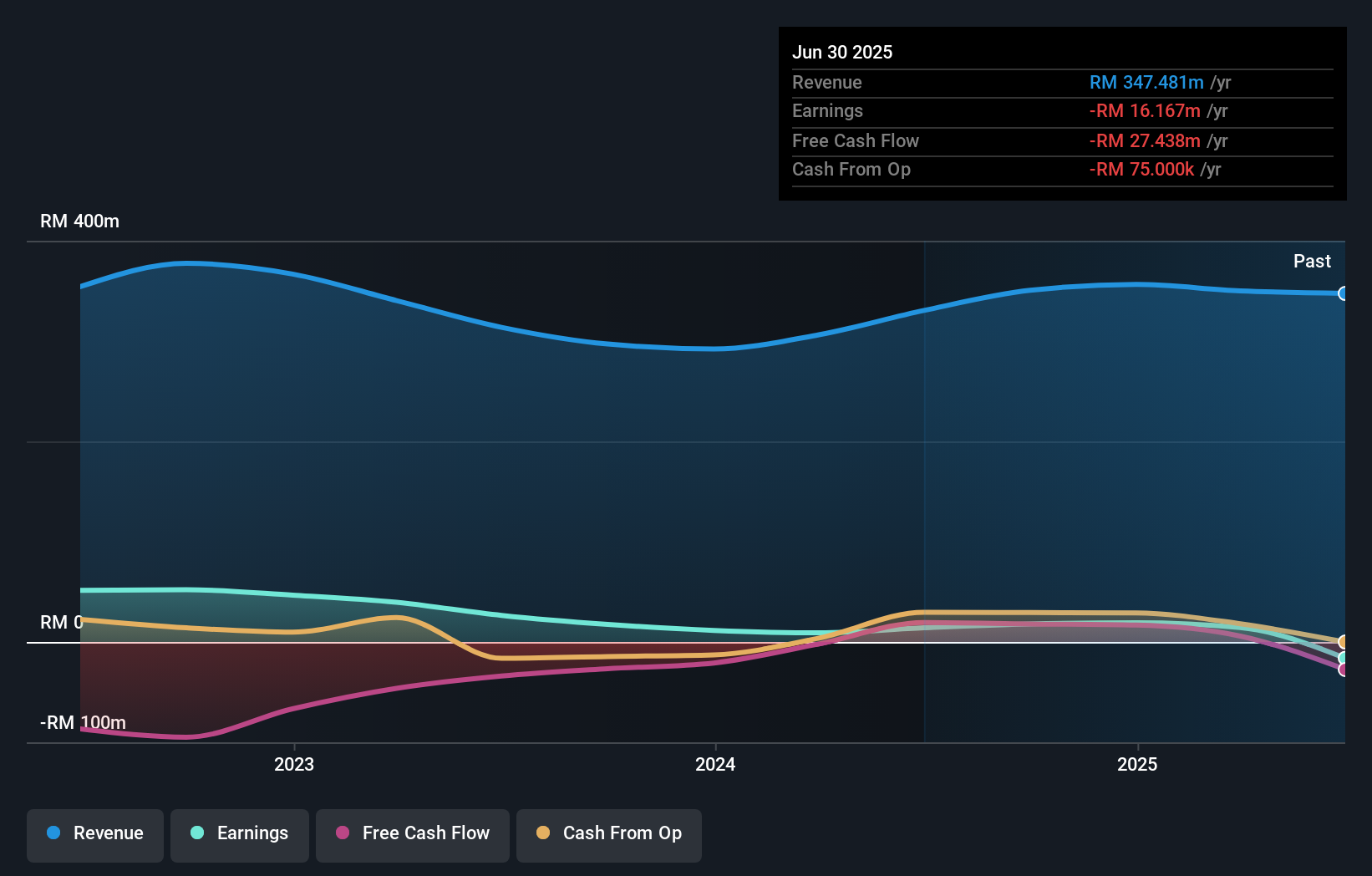

On the other hand, Kobay Technology Bhd's revenue is growing nicely, at a compound rate of 14% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We've already covered Kobay Technology Bhd's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Kobay Technology Bhd shareholders, and that cash payout contributed to why its TSR of 96%, over the last 5 years, is better than the share price return.

A Different Perspective

It's good to see that Kobay Technology Bhd has rewarded shareholders with a total shareholder return of 16% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 14% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Kobay Technology Bhd has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kobay Technology Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KOBAY

Kobay Technology Bhd

An investment holding company, engages in the manufacturing, property development, pharmaceutical and healthcare, and asset management businesses in Malaysia, Singapore, the United States, and internationally.

Mediocre balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives