- Malaysia

- /

- Construction

- /

- KLSE:KKB

Does KKB Engineering Berhad (KLSE:KKB) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like KKB Engineering Berhad (KLSE:KKB). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for KKB Engineering Berhad

KKB Engineering Berhad's Improving Profits

Over the last three years, KKB Engineering Berhad has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. KKB Engineering Berhad boosted its trailing twelve month EPS from RM0.14 to RM0.16, in the last year. I doubt many would complain about that 17% gain.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. KKB Engineering Berhad's EBIT margins have actually improved by 5.1 percentage points in the last year, to reach 15%, but, on the flip side, revenue was down 14%. That falls short of ideal.

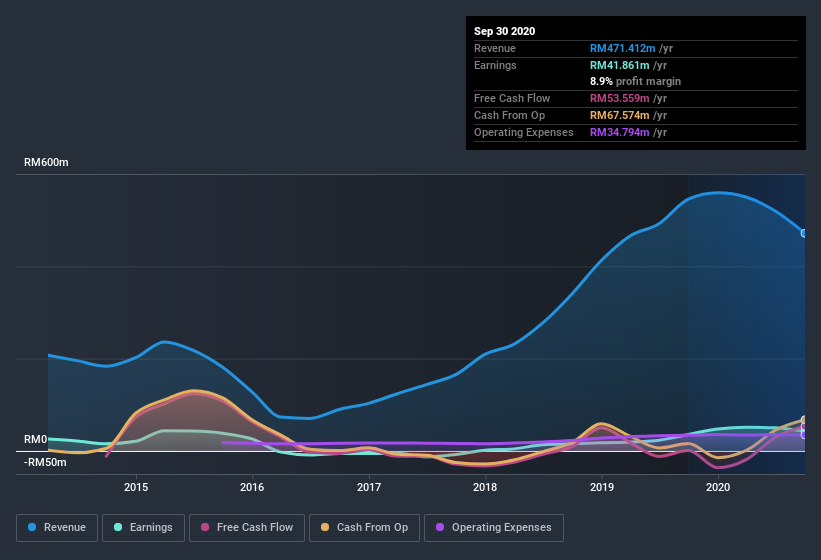

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for KKB Engineering Berhad's future profits.

Are KKB Engineering Berhad Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that KKB Engineering Berhad insiders have a significant amount of capital invested in the stock. To be specific, they have RM88m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 20% of the company; visible skin in the game.

Should You Add KKB Engineering Berhad To Your Watchlist?

One positive for KKB Engineering Berhad is that it is growing EPS. That's nice to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. Before you take the next step you should know about the 1 warning sign for KKB Engineering Berhad that we have uncovered.

Although KKB Engineering Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade KKB Engineering Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KKB Engineering Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KKB

KKB Engineering Berhad

Engages in the steel fabrication, civil construction, hot dip galvanizing, and LP gas cylinders manufacturing businesses in Malaysia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success