- Malaysia

- /

- Construction

- /

- KLSE:KAB

Kejuruteraanstera Berhad (KLSE:KAB) Takes On Some Risk With Its Use Of Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Kejuruteraan Asastera Berhad (KLSE:KAB) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Kejuruteraanstera Berhad

How Much Debt Does Kejuruteraanstera Berhad Carry?

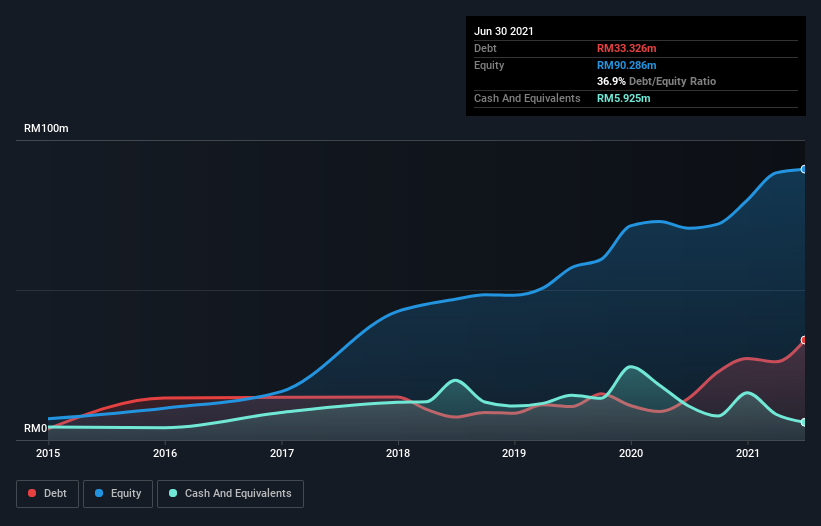

As you can see below, at the end of June 2021, Kejuruteraanstera Berhad had RM33.3m of debt, up from RM13.9m a year ago. Click the image for more detail. On the flip side, it has RM5.93m in cash leading to net debt of about RM27.4m.

How Healthy Is Kejuruteraanstera Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Kejuruteraanstera Berhad had liabilities of RM79.4m due within 12 months and liabilities of RM10.6m due beyond that. On the other hand, it had cash of RM5.93m and RM115.8m worth of receivables due within a year. So it can boast RM31.8m more liquid assets than total liabilities.

This surplus suggests that Kejuruteraanstera Berhad has a conservative balance sheet, and could probably eliminate its debt without much difficulty.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Kejuruteraanstera Berhad's net debt to EBITDA ratio of about 2.3 suggests only moderate use of debt. And its strong interest cover of 18.8 times, makes us even more comfortable. Sadly, Kejuruteraanstera Berhad's EBIT actually dropped 6.2% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. When analysing debt levels, the balance sheet is the obvious place to start. But it is Kejuruteraanstera Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Kejuruteraanstera Berhad burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Neither Kejuruteraanstera Berhad's ability to convert EBIT to free cash flow nor its EBIT growth rate gave us confidence in its ability to take on more debt. But the good news is it seems to be able to cover its interest expense with its EBIT with ease. Looking at all the angles mentioned above, it does seem to us that Kejuruteraanstera Berhad is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Kejuruteraanstera Berhad is showing 4 warning signs in our investment analysis , and 2 of those are a bit concerning...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Kinergy Advancement Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KAB

Kinergy Advancement Berhad

Provides electrical and mechanical engineering services for commercial, industrial, and residential infrastructure in Malaysia, Vietnam, Thailand, Indonesia, and Hong Kong.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives