Should You Be Adding Kumpulan H & L High-Tech Berhad (KLSE:HIGHTEC) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Kumpulan H & L High-Tech Berhad (KLSE:HIGHTEC), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Kumpulan H & L High-Tech Berhad

Kumpulan H & L High-Tech Berhad's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, Kumpulan H & L High-Tech Berhad's EPS has grown 25% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

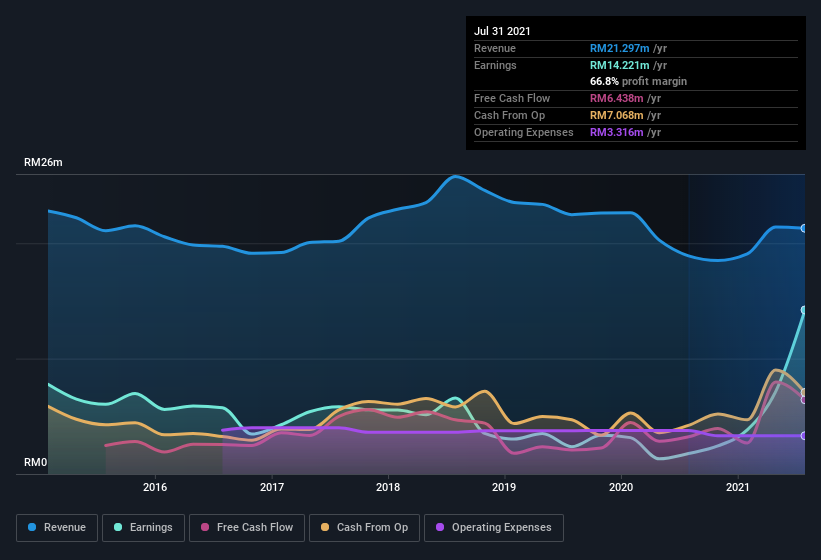

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Kumpulan H & L High-Tech Berhad is growing revenues, and EBIT margins improved by 20.2 percentage points to 32%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Kumpulan H & L High-Tech Berhad is no giant, with a market capitalization of RM219m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Kumpulan H & L High-Tech Berhad Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Kumpulan H & L High-Tech Berhad insiders have a significant amount of capital invested in the stock. Indeed, they hold RM63m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 29% of the company; visible skin in the game.

Is Kumpulan H & L High-Tech Berhad Worth Keeping An Eye On?

You can't deny that Kumpulan H & L High-Tech Berhad has grown its earnings per share at a very impressive rate. That's attractive. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. We don't want to rain on the parade too much, but we did also find 3 warning signs for Kumpulan H & L High-Tech Berhad that you need to be mindful of.

Although Kumpulan H & L High-Tech Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kumpulan H & L High-Tech Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:HIGHTEC

Kumpulan H & L High-Tech Berhad

An investment holding company, manufactures and sells precision engineering moulds, dies, jigs, fixtures, tools, and other precision machine parts in Malaysia, Europe, China, and the United States.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives