- Malaysia

- /

- Trade Distributors

- /

- KLSE:HEXIND

Hextar Industries Berhad's (KLSE:HEXIND) Popularity With Investors Is Clear

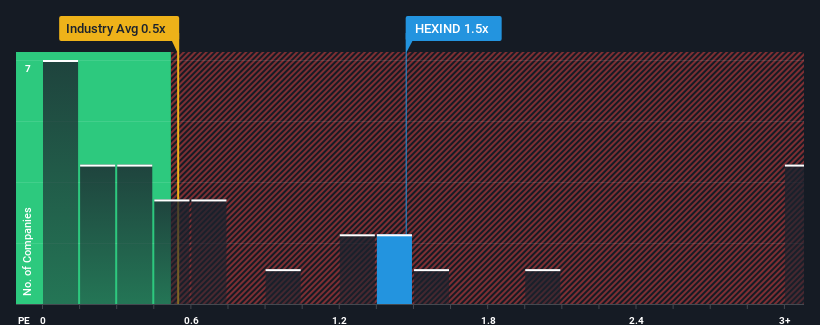

When you see that almost half of the companies in the Trade Distributors industry in Malaysia have price-to-sales ratios (or "P/S") below 0.5x, Hextar Industries Berhad (KLSE:HEXIND) looks to be giving off some sell signals with its 1.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Hextar Industries Berhad

How Hextar Industries Berhad Has Been Performing

As an illustration, revenue has deteriorated at Hextar Industries Berhad over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hextar Industries Berhad will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Hextar Industries Berhad?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hextar Industries Berhad's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 5.4% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

When compared to the industry's one-year growth forecast of 5.2%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Hextar Industries Berhad is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Hextar Industries Berhad's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Hextar Industries Berhad can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Hextar Industries Berhad you should be aware of, and 1 of them is concerning.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hextar Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HEXIND

Hextar Industries Berhad

An investment holding company, engages in the manufacturing, trading, distribution, and wholesale of fertilizers in Malaysia.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives