- Malaysia

- /

- Industrials

- /

- KLSE:HAPSENG

These 4 Measures Indicate That Hap Seng Consolidated Berhad (KLSE:HAPSENG) Is Using Debt Extensively

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Hap Seng Consolidated Berhad (KLSE:HAPSENG) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Hap Seng Consolidated Berhad

What Is Hap Seng Consolidated Berhad's Debt?

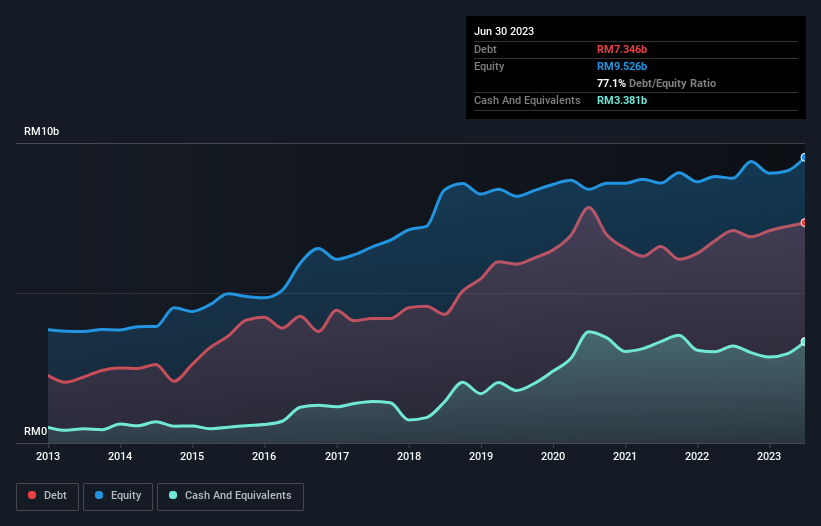

The chart below, which you can click on for greater detail, shows that Hap Seng Consolidated Berhad had RM7.35b in debt in June 2023; about the same as the year before. However, it does have RM3.38b in cash offsetting this, leading to net debt of about RM3.97b.

How Healthy Is Hap Seng Consolidated Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hap Seng Consolidated Berhad had liabilities of RM4.19b due within 12 months and liabilities of RM5.56b due beyond that. Offsetting these obligations, it had cash of RM3.38b as well as receivables valued at RM1.88b due within 12 months. So its liabilities total RM4.48b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Hap Seng Consolidated Berhad is worth RM12.2b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Hap Seng Consolidated Berhad has a debt to EBITDA ratio of 4.1 and its EBIT covered its interest expense 4.7 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Shareholders should be aware that Hap Seng Consolidated Berhad's EBIT was down 52% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is Hap Seng Consolidated Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Hap Seng Consolidated Berhad's free cash flow amounted to 46% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Mulling over Hap Seng Consolidated Berhad's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But at least its conversion of EBIT to free cash flow is not so bad. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Hap Seng Consolidated Berhad stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Hap Seng Consolidated Berhad (2 are a bit concerning) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hap Seng Consolidated Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HAPSENG

Hap Seng Consolidated Berhad

An investment holding company, engages in the plantation, property investment and development, credit financing, automotive, trading, and building materials businesses in Malaysia and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion