- Malaysia

- /

- Construction

- /

- KLSE:ECONBHD

Subdued Growth No Barrier To Econpile Holdings Berhad (KLSE:ECONBHD) With Shares Advancing 26%

Despite an already strong run, Econpile Holdings Berhad (KLSE:ECONBHD) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 158% following the latest surge, making investors sit up and take notice.

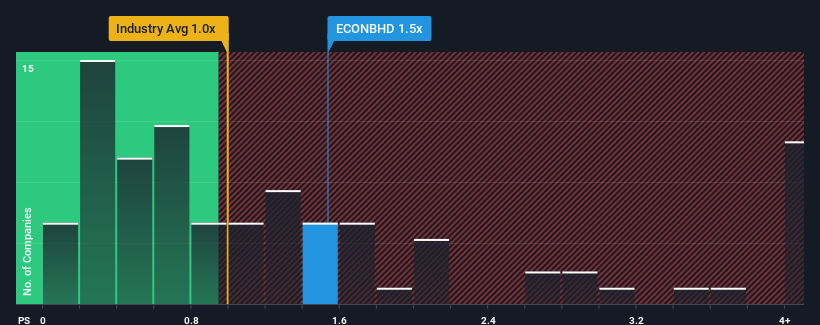

After such a large jump in price, when almost half of the companies in Malaysia's Construction industry have price-to-sales ratios (or "P/S") below 1x, you may consider Econpile Holdings Berhad as a stock probably not worth researching with its 1.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Econpile Holdings Berhad

What Does Econpile Holdings Berhad's P/S Mean For Shareholders?

Econpile Holdings Berhad could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Econpile Holdings Berhad will help you uncover what's on the horizon.How Is Econpile Holdings Berhad's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Econpile Holdings Berhad's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The latest three year period has also seen an excellent 31% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 6.7% as estimated by the four analysts watching the company. That's not great when the rest of the industry is expected to grow by 17%.

With this information, we find it concerning that Econpile Holdings Berhad is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Econpile Holdings Berhad's P/S?

Econpile Holdings Berhad's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

For a company with revenues that are set to decline in the context of a growing industry, Econpile Holdings Berhad's P/S is much higher than we would've anticipated. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

Having said that, be aware Econpile Holdings Berhad is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Econpile Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ECONBHD

Econpile Holdings Berhad

An investment holding company, provides piling and foundation services for high-rise property developments and infrastructure projects in Malaysia and Cambodia.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives