- Malaysia

- /

- Trade Distributors

- /

- KLSE:DKSH

Can You Imagine How DKSH Holdings (Malaysia) Berhad's (KLSE:DKSH) Shareholders Feel About The 25% Share Price Increase?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. To wit, the DKSH Holdings (Malaysia) Berhad (KLSE:DKSH) share price is 25% higher than it was a year ago, much better than the market return of around 3.8% (not including dividends) in the same period. That's a solid performance by our standards! On the other hand, longer term shareholders have had a tougher run, with the stock falling 18% in three years.

Check out our latest analysis for DKSH Holdings (Malaysia) Berhad

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

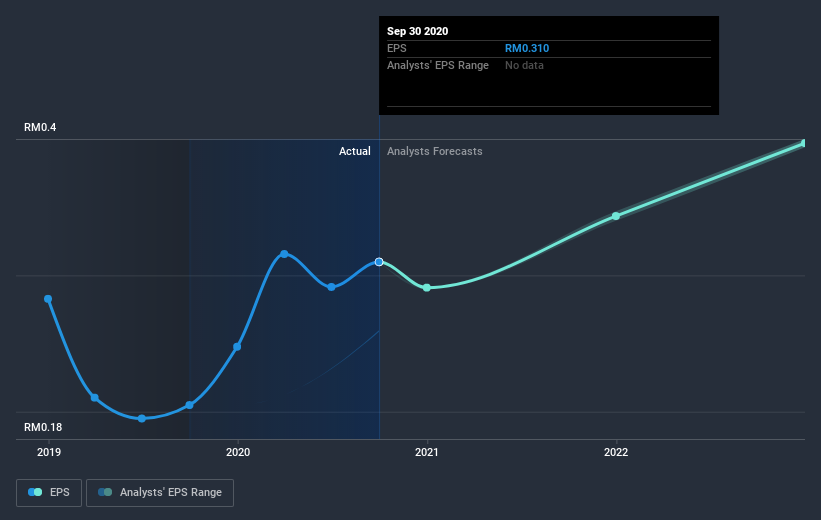

During the last year DKSH Holdings (Malaysia) Berhad grew its earnings per share (EPS) by 51%. This EPS growth is significantly higher than the 25% increase in the share price. So it seems like the market has cooled on DKSH Holdings (Malaysia) Berhad, despite the growth. Interesting. This cautious sentiment is reflected in its (fairly low) P/E ratio of 10.26.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that DKSH Holdings (Malaysia) Berhad has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

We're pleased to report that DKSH Holdings (Malaysia) Berhad shareholders have received a total shareholder return of 25% over one year. There's no doubt those recent returns are much better than the TSR loss of 2% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that DKSH Holdings (Malaysia) Berhad is showing 1 warning sign in our investment analysis , you should know about...

But note: DKSH Holdings (Malaysia) Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade DKSH Holdings (Malaysia) Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:DKSH

DKSH Holdings (Malaysia) Berhad

An investment holding company, provides market expansion services to consumer goods, performance materials, healthcare, and technology industries.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives