CPE Technology Berhad's (KLSE:CPETECH) 30% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/ERatio

CPE Technology Berhad (KLSE:CPETECH) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 36% share price drop.

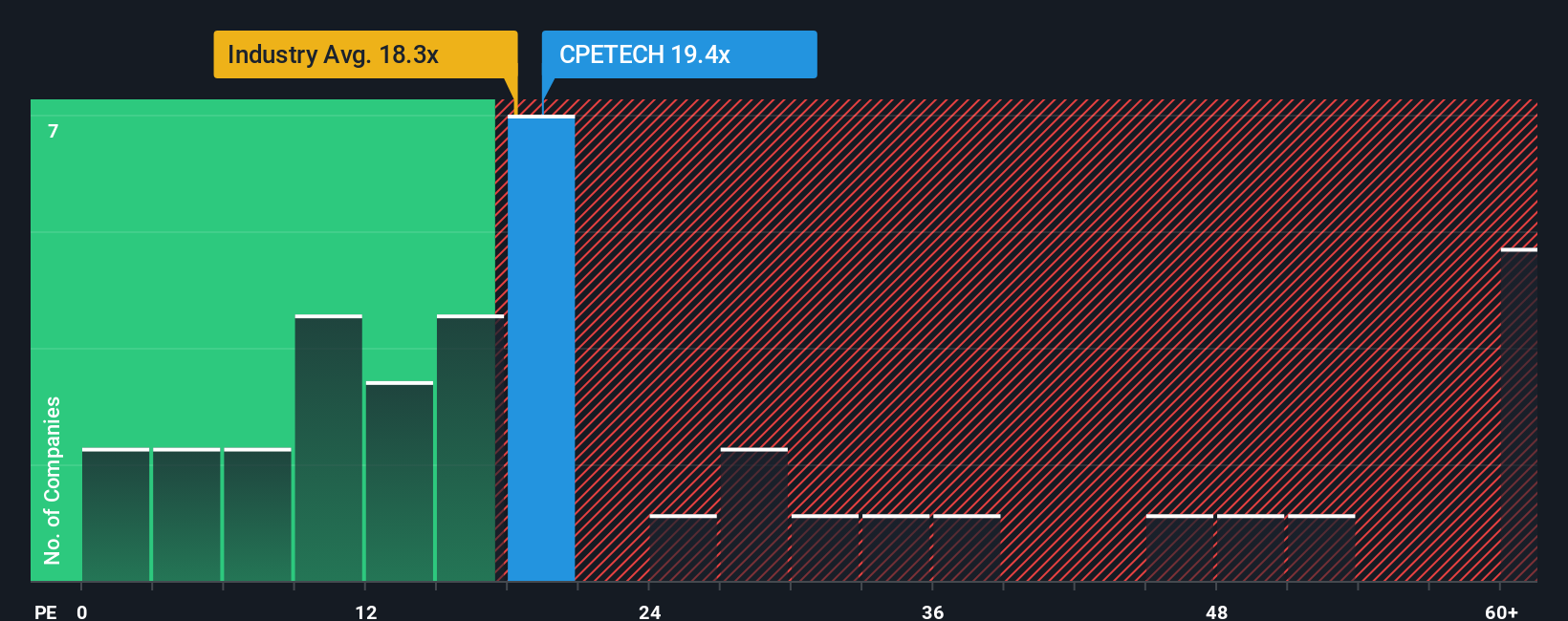

Although its price has dipped substantially, CPE Technology Berhad may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 19.4x, since almost half of all companies in Malaysia have P/E ratios under 14x and even P/E's lower than 8x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's superior to most other companies of late, CPE Technology Berhad has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for CPE Technology Berhad

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as CPE Technology Berhad's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 89% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 48% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 7.1% each year during the coming three years according to the lone analyst following the company. Meanwhile, the rest of the market is forecast to expand by 8.8% per year, which is not materially different.

In light of this, it's curious that CPE Technology Berhad's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

Despite the recent share price weakness, CPE Technology Berhad's P/E remains higher than most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of CPE Technology Berhad's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 2 warning signs for CPE Technology Berhad that you need to take into consideration.

Of course, you might also be able to find a better stock than CPE Technology Berhad. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CPETECH

CPE Technology Berhad

An investment holding company, manufactures and sells precision-machined parts and components primarily in Malaysia.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives