Stock Analysis

- Malaysia

- /

- Construction

- /

- KLSE:BINTAI

The Bintai Kinden Corporation Berhad (KLSE:BINTAI) Share Price Is Up 413% And Shareholders Are Delighted

Bintai Kinden Corporation Berhad (KLSE:BINTAI) shareholders might be concerned after seeing the share price drop 17% in the last quarter. But that doesn't change the fact that the returns over the last year have been spectacular. In fact, it is up 413% in that time. So the recent fall isn't enough to negate the good performance. Only time will tell if there is still too much optimism currently reflected in the share price.

See our latest analysis for Bintai Kinden Corporation Berhad

Bintai Kinden Corporation Berhad wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Bintai Kinden Corporation Berhad actually shrunk its revenue over the last year, with a reduction of 26%. So it's very confusing to see that the share price gained a whopping 413%. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. While this gain looks like speculative buying to us, sometimes speculation pays off.

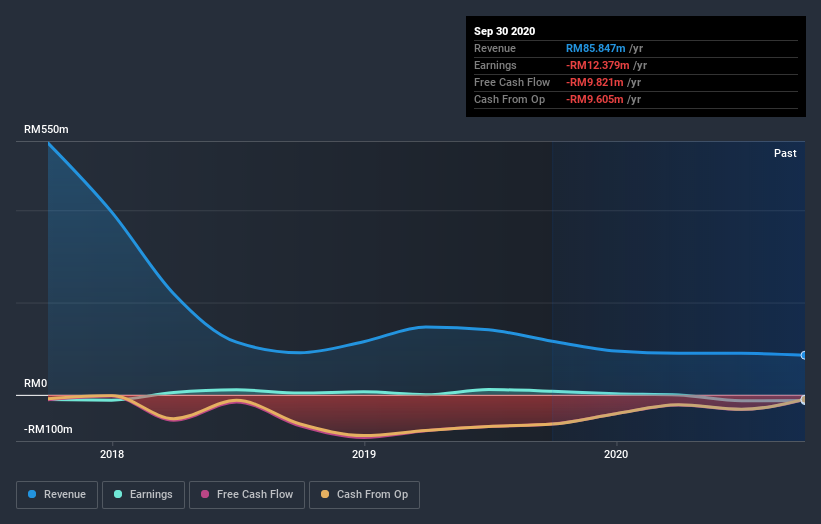

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Bintai Kinden Corporation Berhad stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Bintai Kinden Corporation Berhad shareholders have received a total shareholder return of 413% over the last year. That gain is better than the annual TSR over five years, which is 14%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Bintai Kinden Corporation Berhad better, we need to consider many other factors. Even so, be aware that Bintai Kinden Corporation Berhad is showing 3 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Bintai Kinden Corporation Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Bintai Kinden Corporation Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:BINTAI

Bintai Kinden Corporation Berhad

An investment holding company, provides specialized mechanical and electrical engineering services in South-East Asia, China, and the Arabian Gulf region.

Medium with questionable track record.