- Malaysia

- /

- Construction

- /

- KLSE:AZRB

Ahmad Zaki Resources Berhad (KLSE:AZRB) Seems To Be Using A Lot Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Ahmad Zaki Resources Berhad (KLSE:AZRB) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Ahmad Zaki Resources Berhad's Debt?

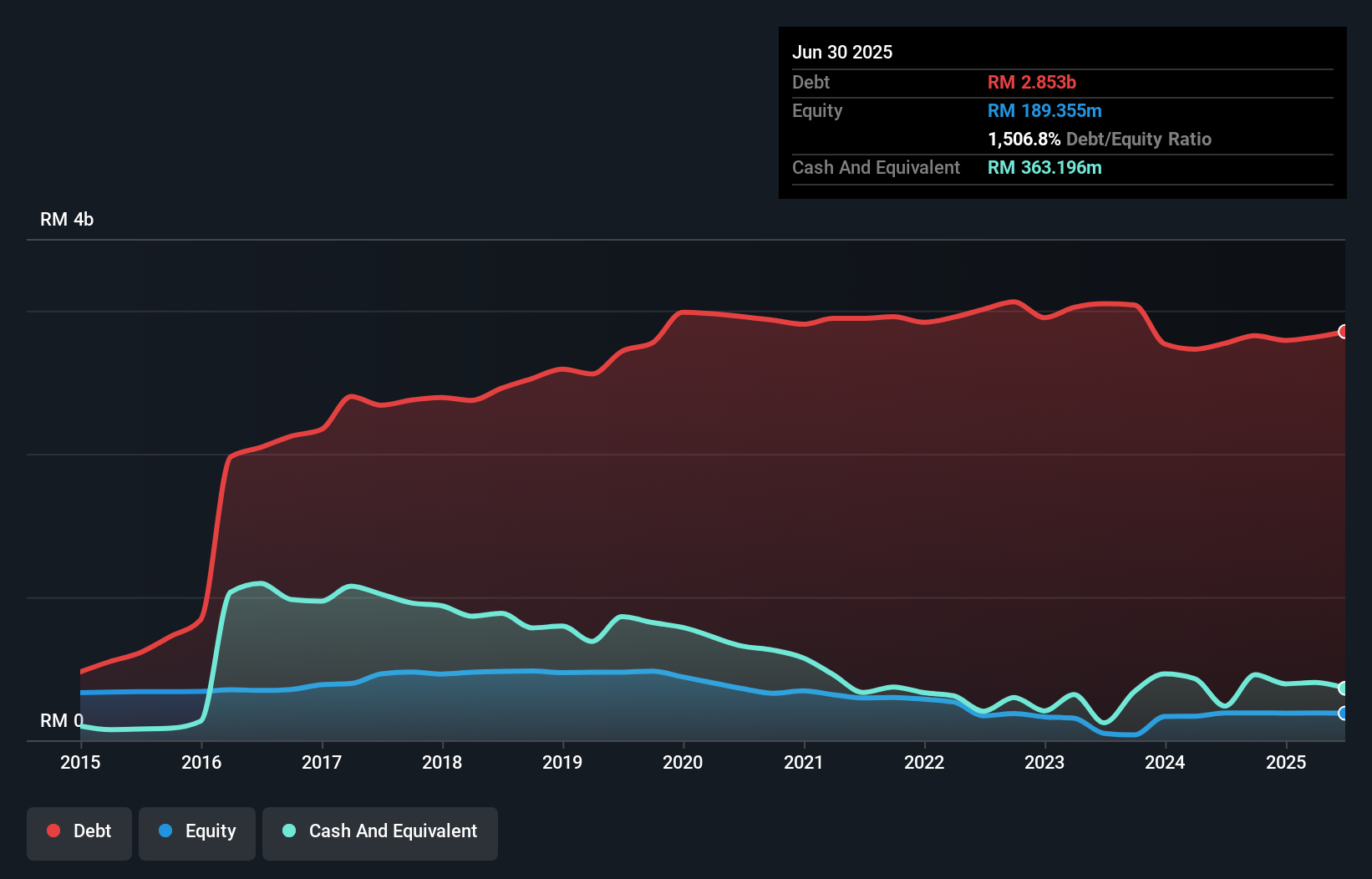

The chart below, which you can click on for greater detail, shows that Ahmad Zaki Resources Berhad had RM2.85b in debt in June 2025; about the same as the year before. However, it does have RM363.2m in cash offsetting this, leading to net debt of about RM2.49b.

How Healthy Is Ahmad Zaki Resources Berhad's Balance Sheet?

The latest balance sheet data shows that Ahmad Zaki Resources Berhad had liabilities of RM1.16b due within a year, and liabilities of RM3.02b falling due after that. On the other hand, it had cash of RM363.2m and RM193.1m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM3.62b.

The deficiency here weighs heavily on the RM105.0m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Ahmad Zaki Resources Berhad would likely require a major re-capitalisation if it had to pay its creditors today.

See our latest analysis for Ahmad Zaki Resources Berhad

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 108, it's fair to say Ahmad Zaki Resources Berhad does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 3.9 times, suggesting it can responsibly service its obligations. Even worse, Ahmad Zaki Resources Berhad saw its EBIT tank 95% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Ahmad Zaki Resources Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Ahmad Zaki Resources Berhad basically broke even on a free cash flow basis. Some might say that's a concern, when it comes considering how easily it would be for it to down debt.

Our View

To be frank both Ahmad Zaki Resources Berhad's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And even its conversion of EBIT to free cash flow fails to inspire much confidence. Considering all the factors previously mentioned, we think that Ahmad Zaki Resources Berhad really is carrying too much debt. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Ahmad Zaki Resources Berhad (including 1 which is a bit unpleasant) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:AZRB

Ahmad Zaki Resources Berhad

Ahmad Zaki Resources Berhad, and investment holding company, provides management services and acts as a contractor of civil and structural works in Malaysia, Indonesia, India, and the Kingdom of Saudi Arabia.

Fair value with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026