APB Resources Berhad's (KLSE:APB) Popularity With Investors Under Threat As Stock Sinks 26%

APB Resources Berhad (KLSE:APB) shares have had a horrible month, losing 26% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 35% in the last year.

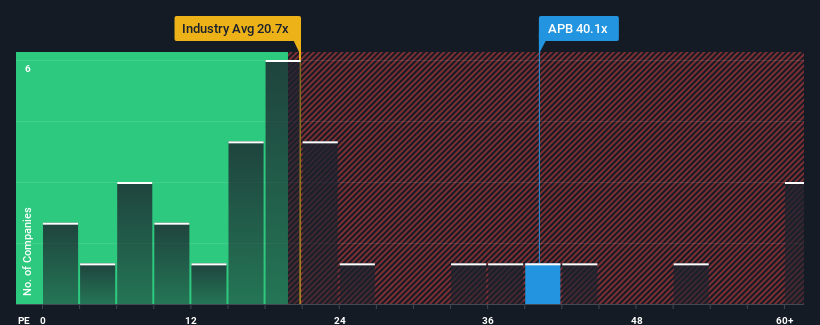

In spite of the heavy fall in price, APB Resources Berhad may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 40.1x, since almost half of all companies in Malaysia have P/E ratios under 15x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For instance, APB Resources Berhad's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for APB Resources Berhad

Is There Enough Growth For APB Resources Berhad?

There's an inherent assumption that a company should far outperform the market for P/E ratios like APB Resources Berhad's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 36%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 45% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is predicted to deliver 16% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it concerning that APB Resources Berhad is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On APB Resources Berhad's P/E

Even after such a strong price drop, APB Resources Berhad's P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of APB Resources Berhad revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider and we've discovered 4 warning signs for APB Resources Berhad (2 are a bit concerning!) that you should be aware of before investing here.

You might be able to find a better investment than APB Resources Berhad. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:APB

APB Resources Berhad

An investment holding company, fabricates specialized design and manufacturing engineering equipment Malaysia and internationally.

Good value with mediocre balance sheet.

Market Insights

Community Narratives