Results: RHB Bank Berhad Exceeded Expectations And The Consensus Has Updated Its Estimates

RHB Bank Berhad (KLSE:RHBBANK) just released its latest quarterly results and things are looking bullish. The company beat both earnings and revenue forecasts, with revenue of RM1.8b, some 8.8% above estimates, and statutory earnings per share (EPS) coming in at RM0.15, 35% ahead of expectations. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for RHB Bank Berhad

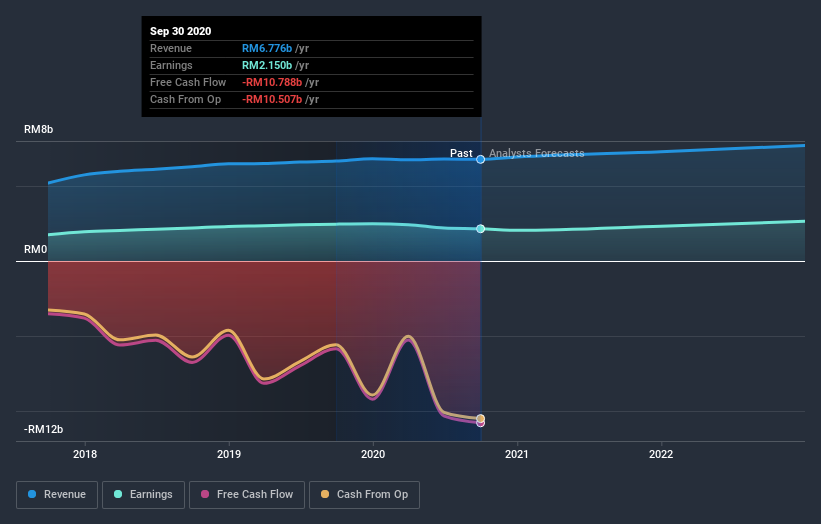

Taking into account the latest results, the current consensus from RHB Bank Berhad's 16 analysts is for revenues of RM7.29b in 2021, which would reflect a satisfactory 7.5% increase on its sales over the past 12 months. Per-share earnings are expected to accumulate 7.6% to RM0.58. In the lead-up to this report, the analysts had been modelling revenues of RM7.20b and earnings per share (EPS) of RM0.56 in 2021. So the consensus seems to have become somewhat more optimistic on RHB Bank Berhad's earnings potential following these results.

The consensus price target rose 5.5% to RM5.90, suggesting that higher earnings estimates flow through to the stock's valuation as well. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic RHB Bank Berhad analyst has a price target of RM6.54 per share, while the most pessimistic values it at RM5.00. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the RHB Bank Berhad's past performance and to peers in the same industry. It's clear from the latest estimates that RHB Bank Berhad's rate of growth is expected to accelerate meaningfully, with the forecast 7.5% revenue growth noticeably faster than its historical growth of 4.7%p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 5.4% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that RHB Bank Berhad is expected to grow much faster than its industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards RHB Bank Berhad following these results. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for RHB Bank Berhad going out to 2022, and you can see them free on our platform here..

Plus, you should also learn about the 1 warning sign we've spotted with RHB Bank Berhad .

If you decide to trade RHB Bank Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:RHBBANK

RHB Bank Berhad

Provides commercial banking and finance related products and services in Malaysia and internationally.

Excellent balance sheet average dividend payer.