AFFIN Bank Berhad (KLSE:AFFIN) Will Pay A Smaller Dividend Than Last Year

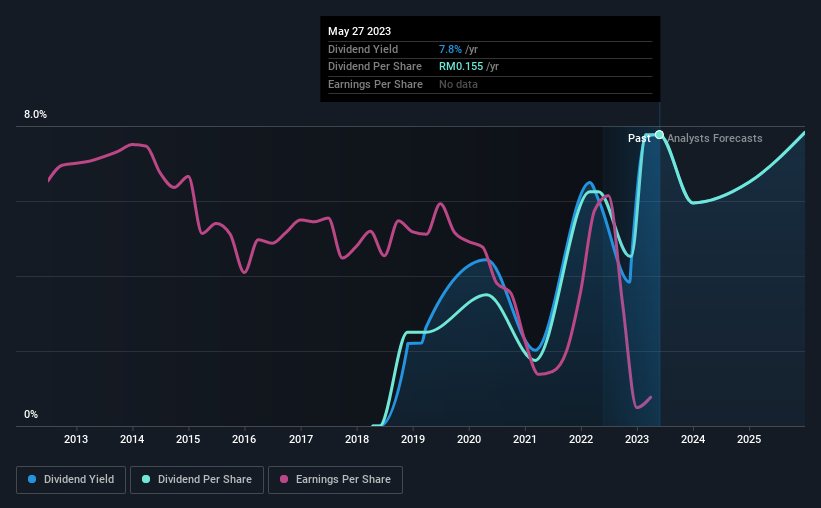

AFFIN Bank Berhad (KLSE:AFFIN) has announced that on 11th of July, it will be paying a dividend ofMYR0.0777, which a reduction from last year's comparable dividend. The yield is still above the industry average at 7.8%.

See our latest analysis for AFFIN Bank Berhad

AFFIN Bank Berhad's Payment Expected To Have Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable.

Having paid out dividends for only 4 years, AFFIN Bank Berhad does not have much of a history being a dividend paying company. Past distributions unfortunately do not guarantee future ones, and AFFIN Bank Berhad's last earnings report actually showed that the company went over its net earnings in its total dividend distribution. This is an alarming sign that could mean that AFFIN Bank Berhad's dividend may no longer be sustainable for longer.

According to analysts, EPS should be several times higher in the next 3 years. They also expect the future payout ratio to be 48% over the same period, which would make us comfortable with the dividend's sustainability, despite the levels currently being elevated.

AFFIN Bank Berhad's Dividend Has Lacked Consistency

Even in its short history, we have seen the dividend cut. Since 2019, the dividend has gone from MYR0.05 total annually to MYR0.155. This implies that the company grew its distributions at a yearly rate of about 33% over that duration. AFFIN Bank Berhad has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

Dividend Growth Potential Is Shaky

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Earnings per share has been sinking by 32% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

We're Not Big Fans Of AFFIN Bank Berhad's Dividend

In summary, it's not great to see that the dividend is being cut, but it is probably understandable given that the current payment level was quite high. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, the dividend is not reliable enough to make this a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 4 warning signs for AFFIN Bank Berhad (of which 1 shouldn't be ignored!) you should know about. Is AFFIN Bank Berhad not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:AFFIN

AFFIN Bank Berhad

A financial holding company, provides various banking services in Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives