- Malaysia

- /

- Auto Components

- /

- KLSE:NHFATT

How Much Did New Hoong Fatt Holdings Berhad's (KLSE:NHFATT) CEO Pocket Last Year?

In 2007, Jit Chin was appointed CEO of New Hoong Fatt Holdings Berhad (KLSE:NHFATT). First, this article will compare CEO compensation with compensation at similar sized companies. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for New Hoong Fatt Holdings Berhad

How Does Jit Chin's Compensation Compare With Similar Sized Companies?

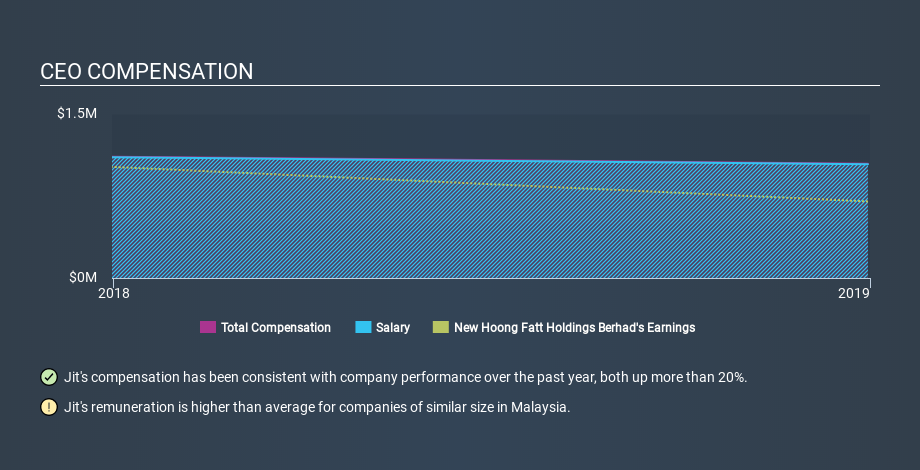

Our data indicates that New Hoong Fatt Holdings Berhad is worth RM166m, and total annual CEO compensation was reported as RM1.0m for the year to December 2018. It is worth noting that the CEO compensation consists almost entirely of the salary, worth RM1.0m. We examined a group of similar sized companies, with market capitalizations of below RM863m. The median CEO total compensation in that group is RM621k.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where New Hoong Fatt Holdings Berhad stands. On an industry level, roughly 84% of total compensation represents salary and 16% is other remuneration. New Hoong Fatt Holdings Berhad has gone down a largely traditional route, paying Jit Chin a high salary, giving it preference as a compensation method to non-salary benefits.

Thus we can conclude that Jit Chin receives more in total compensation than the median of a group of companies in the same market, and of similar size to New Hoong Fatt Holdings Berhad. However, this doesn't necessarily mean the pay is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous. You can see, below, how CEO compensation at New Hoong Fatt Holdings Berhad has changed over time.

Is New Hoong Fatt Holdings Berhad Growing?

Over the last three years New Hoong Fatt Holdings Berhad has shrunk its earnings per share by an average of 29% per year (measured with a line of best fit). In the last year, its revenue is up 4.7%.

Sadly for shareholders, earnings per share are actually down, over three years. And the modest revenue growth over 12 months isn't much comfort against the reduced earnings per share. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has New Hoong Fatt Holdings Berhad Been A Good Investment?

Given the total loss of 44% over three years, many shareholders in New Hoong Fatt Holdings Berhad are probably rather dissatisfied, to say the least. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

We examined the amount New Hoong Fatt Holdings Berhad pays its CEO, and compared it to the amount paid by similar sized companies. We found that it pays well over the median amount paid in the benchmark group.

Neither earnings per share nor revenue have been growing sufficiently to impress us, over the last three years. Just as bad, share price gains for investors have failed to materialize, over the same period. Some might well form the view that the CEO is paid too generously! Taking a breather from CEO compensation, we've spotted 5 warning signs for New Hoong Fatt Holdings Berhad (of which 1 is potentially serious!) you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KLSE:NHFATT

New Hoong Fatt Holdings Berhad

An investment holding company, manufactures, markets, distributes, and trades in automotive parts and accessories in the replacement market.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion