- Malaysia

- /

- Auto Components

- /

- KLSE:KHB

KHPT Holdings Berhad (KLSE:KHB) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

To the annoyance of some shareholders, KHPT Holdings Berhad (KLSE:KHB) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

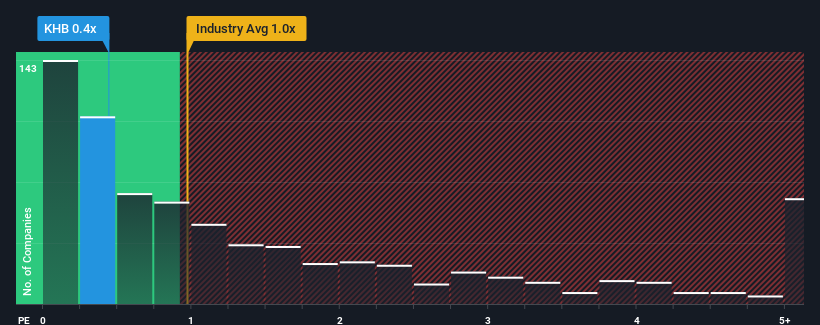

Even after such a large drop in price, it's still not a stretch to say that KHPT Holdings Berhad's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Auto Components industry in Malaysia, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for KHPT Holdings Berhad

How KHPT Holdings Berhad Has Been Performing

KHPT Holdings Berhad hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think KHPT Holdings Berhad's future stacks up against the industry? In that case, our free report is a great place to start.How Is KHPT Holdings Berhad's Revenue Growth Trending?

KHPT Holdings Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.9%. Still, the latest three year period has seen an excellent 78% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the two analysts following the company. That's shaping up to be similar to the 14% growth forecast for the broader industry.

With this in mind, it makes sense that KHPT Holdings Berhad's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From KHPT Holdings Berhad's P/S?

With its share price dropping off a cliff, the P/S for KHPT Holdings Berhad looks to be in line with the rest of the Auto Components industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that KHPT Holdings Berhad maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for KHPT Holdings Berhad (of which 1 doesn't sit too well with us!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if KHPT Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KHB

KHPT Holdings Berhad

An investment holding company, manufactures and sells automotive parts and components in Malaysia.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives